This Home Affordability Calculator allows the end user to compute their purchase price, total monthly payment and the PMI (Private mortgage insurance).

Prerequisites

- Users should have the Error Handling Accelerator installed before utilizing this Accelerator.

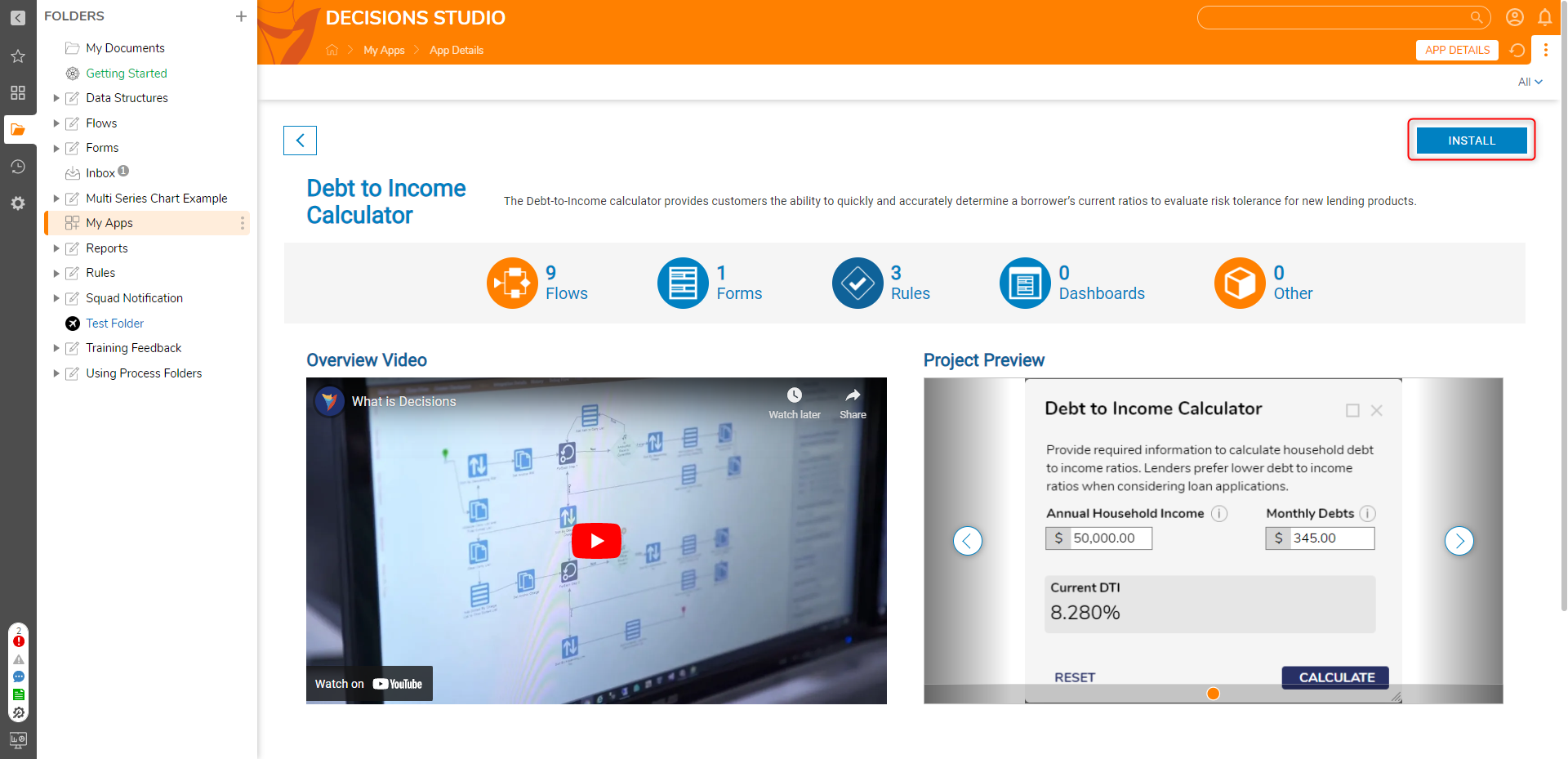

Installing App Store Applications

- Navigate to the App Store in the Folders tab.

- Search for the Home Affordability Calculator in the Not Installed section and select Details.

- On the App Details Page, select INSTALL.

What's Included

Below is a list of items included in the Application. Hidden items are marked with an asterisk.

Flows

- Home Affordability Calculator [Primary Flow]

- Amortization Calculation

- Calculate Home Affordability

- Calculate Interest Paid From Monthly Interest Rate

- Calculate Maximum Monthly Payment

- Calculate Monthly Principal and Interest

- Calculate Purchase Price

- Compute Monthly Interest and Principle

- Create Line Definitions

- Evaluate with PMI

- Get Interest Paid and Principal Paid for Current Year

- *[AFF] Calculate

- *[AFF] Hide/Show/Disable Elements

- *[AFF] Reset All Fields

- *[AFF] Show Loan Term Field

Forms

- Home Affordability Calculator

- Home Affordability Chart Representation

Rule Table

- Home Affordability Field Validations

Truth Tables

- Financing Type Truth Table

- PMI Required Truth Table

Diagram Tile

- Home Affordability Pie Chart

Glossary of Terms

| Term | Description |

|---|---|

| Annual Household Income | Gross earnings before taxes. This includes base salary, commission, bonuses, and or tips. |

| Monthly Household Debts | Monthly debts include minimum credit card payments, student loans, car loans, personal loans, and mortgages or rent. |

| Down Payment | The initial payment made when something is bought on credit, in this case, a home. |

| Annual Property Tax | The tax paid on property owned by an individual or legal entity varies based on state and location. |

| Annual Homeowners Insurance | a form of property insurance that covers losses and damages to an individual's house and assets in the home. |

| Loan Term | Depending on the user's selection, they can provide terms in months or in years that they'd want to pay off the provided loan amount. |

| Interest Rate (APR%) | The amount of interest applied to the outstanding balance annually |

| Type of Financing | The type of loan a user has to finance the loan: Conventional, FHA, and VA are the initial options the calculator supports. Users could add more to this list and update the paired truth table. |

| Purchase Price | This is the maximum purchase price you can afford for a home. This included the down payment and the total amount of a home. |

| Total Monthly Payment | This payment consists of Principal and Interest, Property tax, homeowners insurance, association fees, and PMI if required. |

| PMI Required | Private mortgage insurance (PMI) may be required for borrowers with less than 20% down. PMI rate typically ranges from 0.58%-1.86% and will depend on your credit score LTV and DTI ratios. Based on your provided downpayment, monthly PMI has been calculated. |

Configuration

No additional setup is required once the application is installed. Follow the below sections on Implementation to embed or run from a URL as a service.

Embedding the Form

The Form can be used on an external page. Follow the article on Embed a Form in a Web App to achieve this implementation.

Run the Flow from a URL

Flows can be run using a URL. This can be accomplished on the Primary Flow, Home Affordability Calculator. Follow the Running a Flow from a URL article to achieve this.

Home Affordability Calculator Flow [Primary Flow]

This Flow runs the Home Affordability Calculator Form, which allows the end-user to compute their purchase price, total monthly payment, and PMI.

- In the Annual Household Income Currency Box, enter the total gross income before taxes received within a 12-month period.

- In the Monthly Household Debts Currency Box, enter all liabilities of households (including non-profit institutions serving households) that require monthly payments.

- In the Down Payment Currency Box, Enter the initial payment amount.

- In the Annual Property Tax Currency Box, enter the annual amount paid to the government for property taxes.

- In the Annual Homeowner's Insurance Currency Box, enter the home's annual insurance price.

- In the Annual HOA/Condo Fees Currency Box, Enter the annual recurring fee to pay the organization. This field is optional.

- Select the desired units for the loan term using the drop-down options. The loan term can be entered in either months or years. By default, Loan Term in Months is selected.

- Selecting the Loan Term in Months option will display a number spinner that increases and decreases in increments of 12.

- Selecting the Loan Term in Years option will display a number spinner that increases and decreases by 1.

- Enter the desired loan term in the Number Spinner Box by either pressing the up and down arrows or typing a number in the box.

- In the Interest Rate (APR%) Number Box, enter the amount of interest applied to the outstanding balance annually.

- In the Type of Financing drop-down, select the desired loan type.

- Click Calculate or hit the "Enter" key. This will populate Purchase Price, Total Monthly Payment, and PMI in the results fields.

- Upon using the Calculate button, the View Chart button will be revealed. Clicking this button will redirect the end user to another form containing a pie chart displaying the home affordability breakdown. If the end user enters any inaccurate information different from the market standards, then the form will show specific validation related to each field when the user enters the calculate button.

- Clicking the Back button will return the end user to the calculator form.

- Clicking the Reset button will clear all form fields.