The Loan Calculators Accelerator is an intuitive interface that houses nine calculators that assist Users in common lending and finance calculations with pre-designed Flows.

The College Cost Estimator Flow triggers a Form for End Users to enter details to calculate the expected cost of college, including contributions and any additional costs if necessary. The Debt-to-Income Calculator Flow takes in a User's annual household income, as well as monthly debts, then triggers a Form that calculates a percentage representing the Debt-to-Income Ratio.

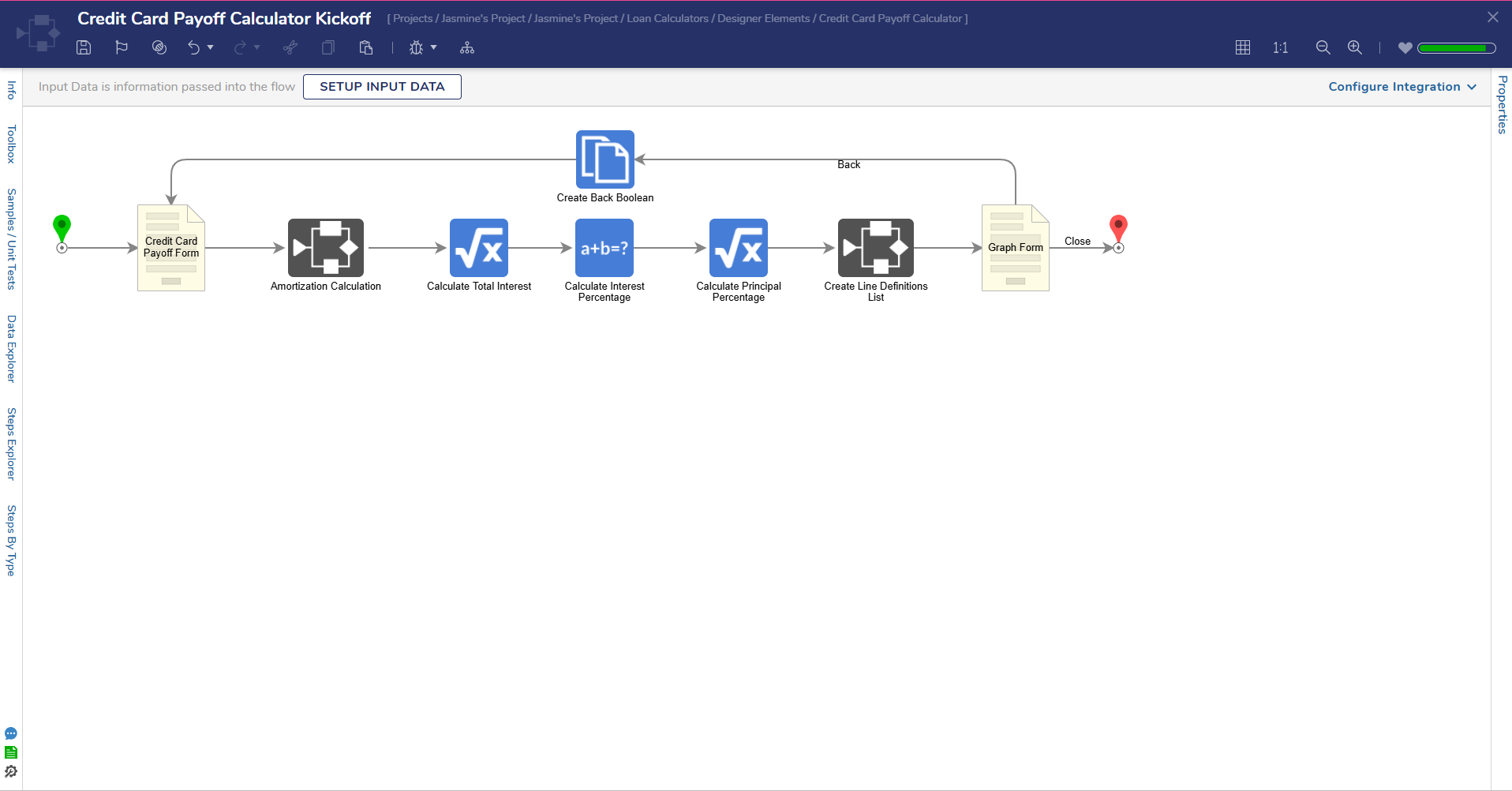

The Credit Card Payoff Calculator Kickoff Flow takes in a User's credit card balance, APR percentage, and a choice to generate a fixed monthly payment, minimum payment percentage, or years to payoff. After the Form is completed, the Form populates calculations for the monthly payment, months until payoff, and total interest paid.

The Loan Calculators Accelerator provides an easy-to-use platform that assists with financial calculations fully within the Decisions environment.

Prerequisites

- Users should have the Error Handling Accelerator installed before utilizing this Accelerator.

What Calculators are Included

- Student Loan Calculator

- Loan-to-Value Calculator

- Debt to Income Calculator

- Credit Card Payoff Calculator

- Installment Calculator

- College Cost Estimator

- Home Affordability Calculator

- Amortization Calculator

- Debt Consolidation Calculator

Student Loan Calculator

Student Loan Calculator Flow

This Flow triggers the Student Loan Calculator Form, which allows End Users to compute a student loan payoff summary based on their loan balance, monthly payment, and interest rate. If additional repayments are provided, the calculator also computes a payoff summary considering these additional payments.

Utilizing the Student Loan Calculator

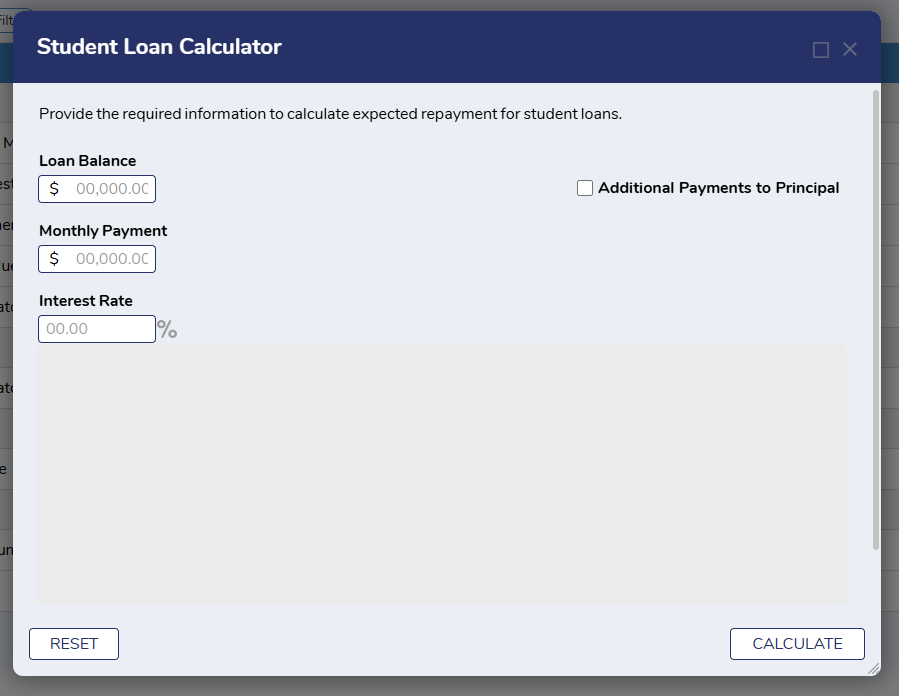

To use the Student Loan Calculator:

- Navigate to the Student Loan Calculator Form and enter the amount borrowed or remaining on the student loan in the Loan Balance Currency Box.

- In the Monthly Payment Currency Box, enter the monthly amount paid on the student loan.

- In the Interest Rate Number Box, enter the amount of interest that is annually applied to the loan.

- The Student Loan Calculator can also calculate additional repayment options. These options enable End Users to consider extra monthly, yearly, or one-time payments to the principal when calculating their payoff. The calculator can account for one of these extra payment options or a combination of an extra one-time, monthly, or annual payment. This can be accomplished by:

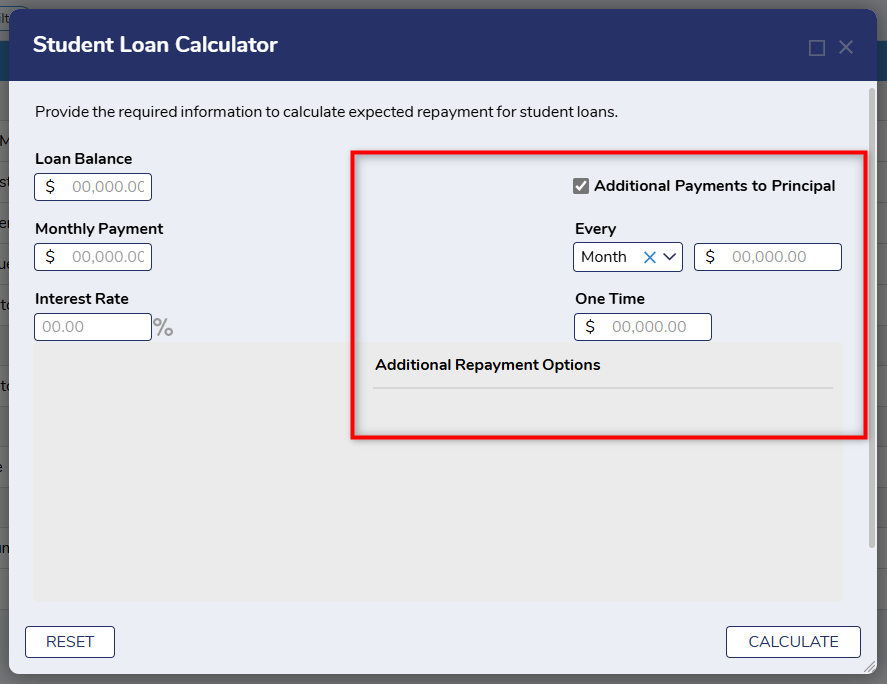

- Checking the Additional Payments to Principal checkbox. This action will reveal fields to enter additional repayment options.

- To include extra monthly payments, select Month from the dropdown list and enter the extra monthly payment amount in the adjacent Number Box.

- To include extra annual payments, select Year from the dropdown and enter the extra annual payment amount in the adjacent Number Box.

- To include an extra one-time payment, enter the desired amount in the One-Time Currency Box.

- The Student Loan Calculator can also calculate additional repayment options. These options enable End Users to consider extra monthly, yearly, or one-time payments to the principal when calculating their payoff. The calculator can account for one of these extra payment options or a combination of an extra one-time, monthly, or annual payment. This can be accomplished by:

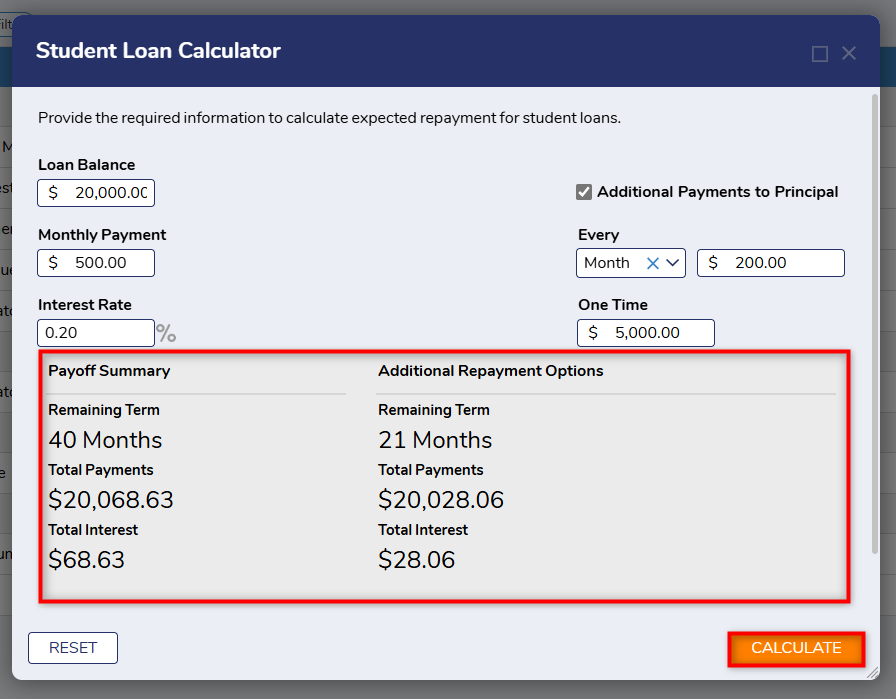

- After the desired information has been entered, click Calculate. This action will populate the Remaining Term, Total Payments, and Total Interest in the results fields below for the Original Payoff Summary.

- These results do not account for any additional repayment options and only take the loan balance, monthly payment, and interest rate into consideration. If additional repayments have been selected, another set of results will be populated with these extra payments considered.

- In this case, the Remaining Term, Total Payments, and Total Interest will be shown in the Additional Payment Summary.

- These results do not account for any additional repayment options and only take the loan balance, monthly payment, and interest rate into consideration. If additional repayments have been selected, another set of results will be populated with these extra payments considered.

Loan to Value Calculator

Glossary of Terms

| Term | Description |

|---|---|

| Balanced Owed | The loan balance associated with the collateral, including any new or existing liens. |

| Current Market Value | The appraised value of the collateral. |

| Current LTV | Loan-to-value ratio is calculated as LTV=L/V, where L is the balance and V is the current market value. |

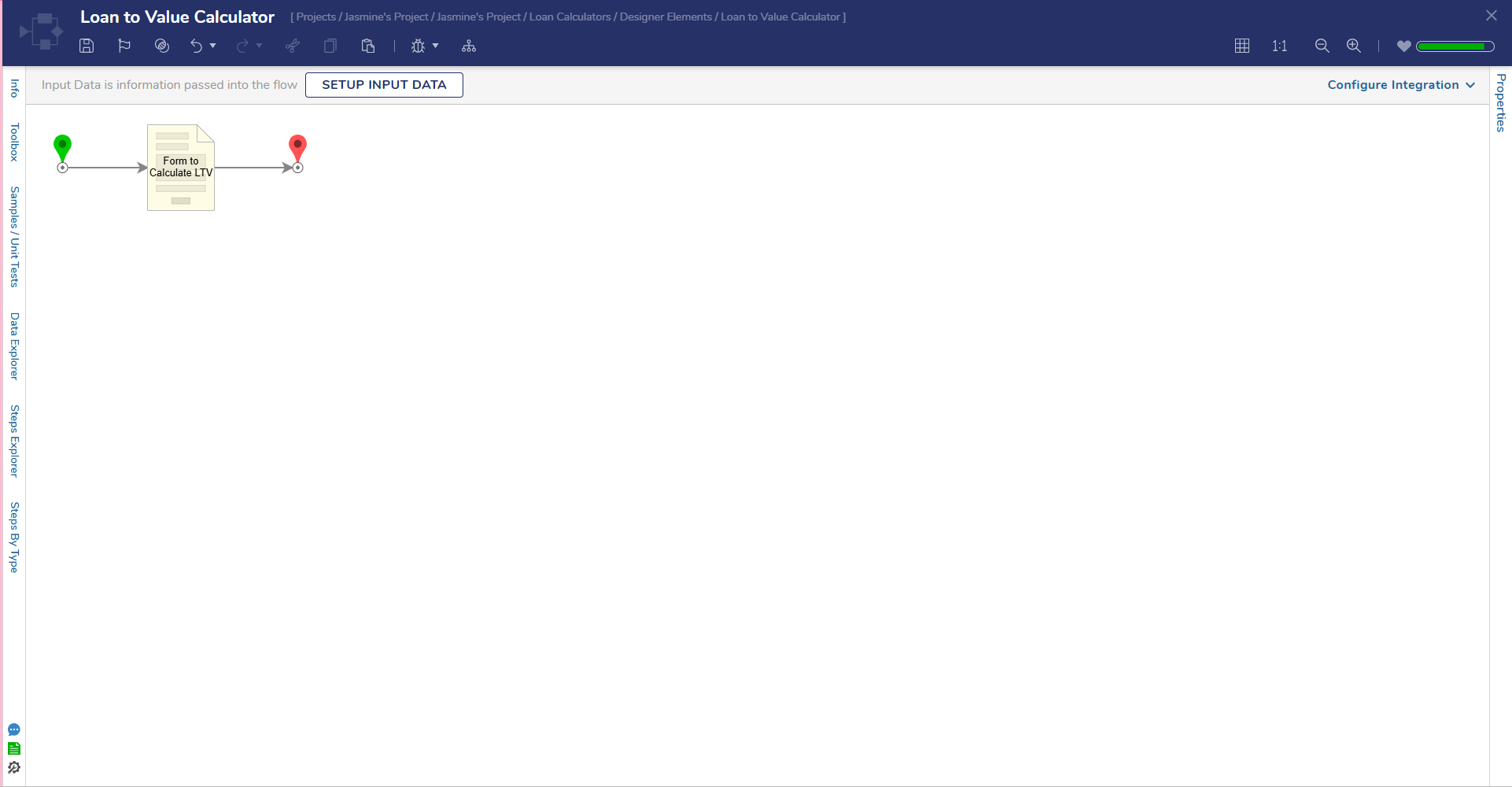

Loan to Value Calculator Flow

This Flow triggers the LTV Calculator Form, which allows the borrower to quickly compute a Loan-to-value percentage based on the Balanced Owed and the Collateral Value.

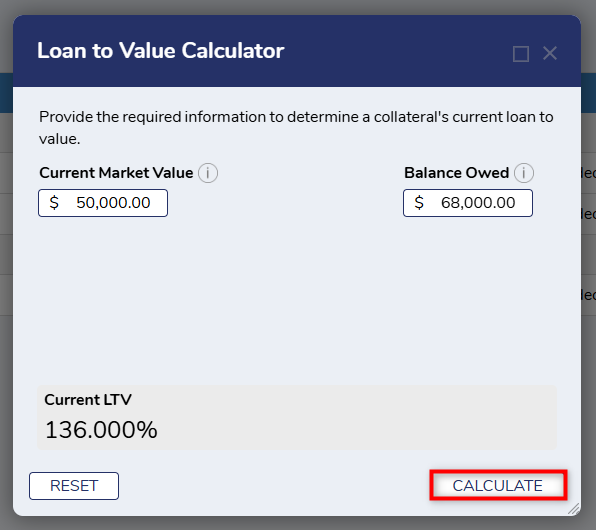

Utilizing the Loan-to-Value Calculator

To utilize the LTV Calculator:

- Enter the collateral's current market value in the Current Market Value Currency Box.

- In the Balanced Owned Currency Box, enter the balance owed on the collateral.

- After the required fields have been completed, select Calculate. This action will populate the Current LTV Percentage in the results field below.

- Select the Reset button to clear all form fields.

- Hover on ToolTip icons to display help text.

Debt-to-Income Calculator

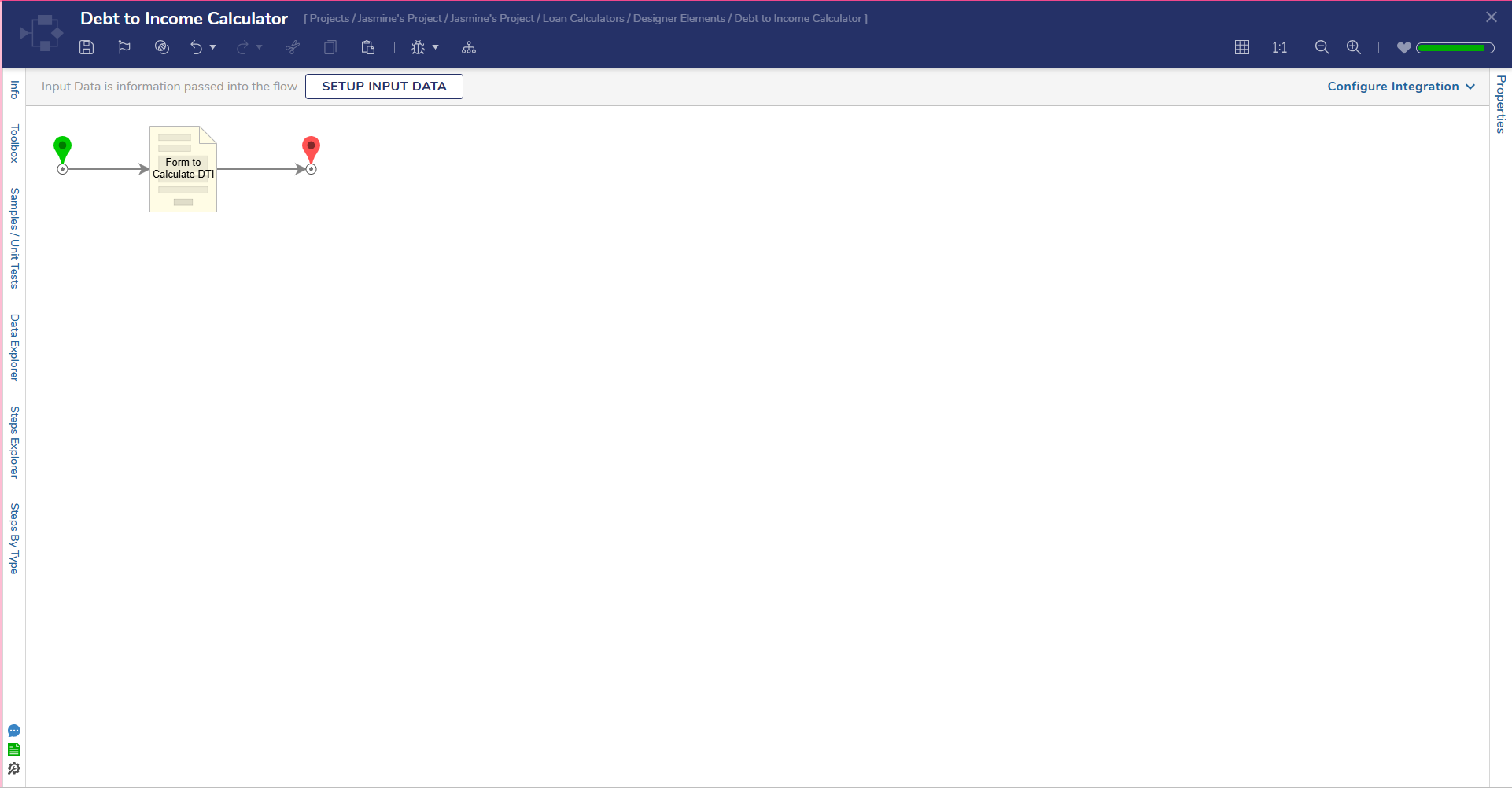

Debt to Income Calculator Flow

This Flow runs the DTI Calculator Form, which allows the borrower to quickly compute a Debt-to-Income value in percentage based on given Monthly Debt and Annual Household Income.

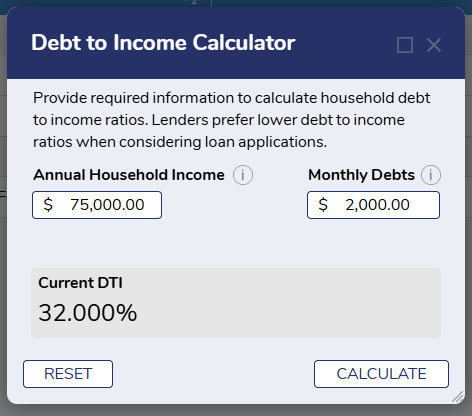

Utilizing the Debt-to-Income Calculator

- Run the Debt-to-Income Calculator Flow to open the Debt-to-Income Calculator Form.

- In the Annual Household Income Currency Box, enter the gross earnings before taxes. The Annual Household Income will be divided by 12 to get the Monthly Gross Income.

- In the Monthly Debts Currency Box, enter the total amount of debt paid monthly.

- Select Calculate. This populates the Current DTI Percentage in the Results field.

- Select Reset to clear all Form Fields.

Credit Card Payoff Calculator

Credit Card Payoff Calculator Kickoff Flow

This Flow runs the Credit Card Payoff Calculator Form, which enables End Users to compute their monthly payment, total interest paid, number of years until payoff, and number of months until payoff.

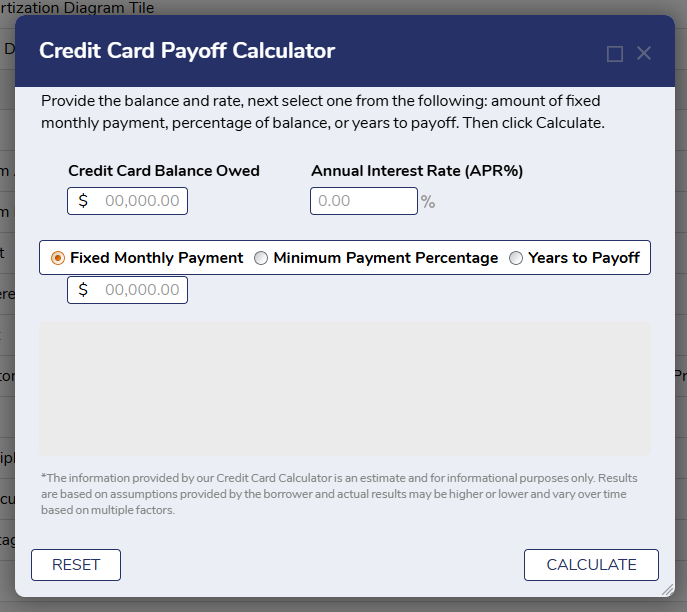

Utilizing the Credit Card Calculator

To utilize the Credit Card Calculator:

- Enter the Outstanding Balance on the credit card in the Credit Card Balance Currency Box.

- Then, enter the Annual Percentage Rate in the Percentage Box.

- Select the desired type of calculation using the radio button options. Selecting one of these options will reveal a corresponding control.

- Fixed Monthly Payment is selected by default.

- Selecting the Minimum Payment Percentage option will display a dropdown that has percentages from 1%-5%

- Selecting the Fixed Monthly Payment option displays a Currency Box where End Users can enter the desired amount.

- Selecting the Years to Payoff option displays the Number Box where End Users can enter the desired number of years.

- Fixed Monthly Payment is selected by default.

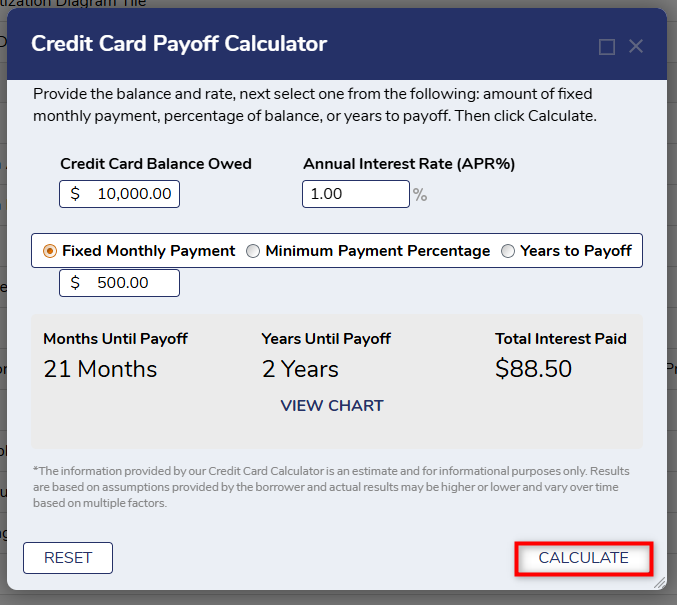

- After the required fields are completed, select Calculate. This action will populate the Monthly Until Payoff, Years Until Payoff and Total Interest Paid in the results fields below.

- When the Years to Payoff option is selected for the calculation, the results fields will include the Months until Payoff, Monthly Payment and Total Interest Paid.

- When the Years to Payoff option is selected for the calculation, the results fields will include the Months until Payoff, Monthly Payment and Total Interest Paid.

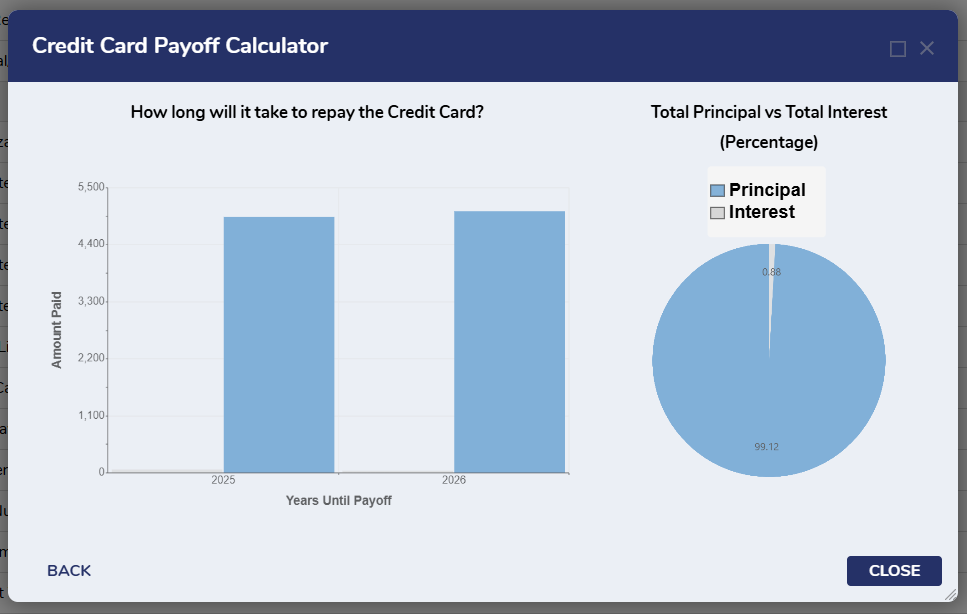

- Once the Form is calculated, the View Chart button will be revealed. Selecting this button will redirect End Users to another Form that contains two charts:

- The Credit Card Repayment Bar Chart displays the amount of interest and amount of principle that will be paid over the repayment period.

- The Principal vs. Interest Pie Chart displays what percentage of the total amount paid was interest and what percentage was principal.

- Clicking the Back button will return End Users to the Calculator Form.

- Clicking the Reset button will clear all form fields.

Installment Loan Calculator

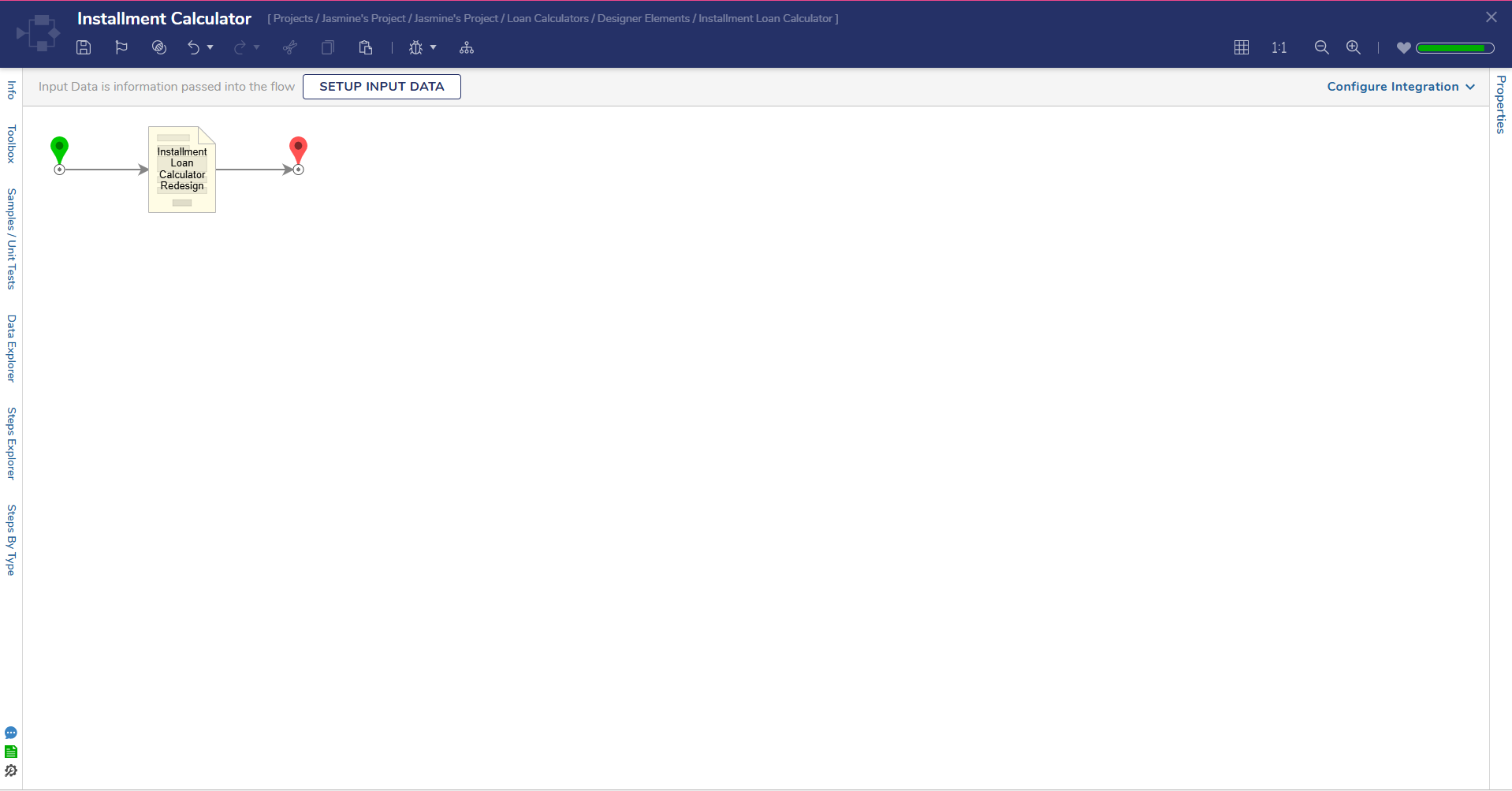

Installment Calculator Flow

This Flow runs the Installment Calculator Form, which allows End Users to compute a comfortable loan payment based on their credit score and loan details.

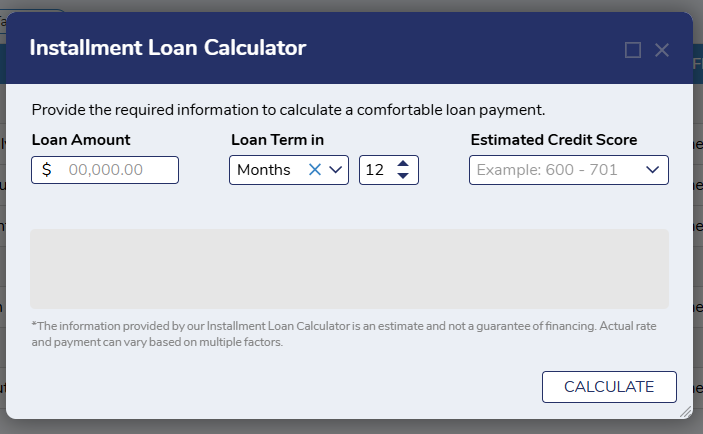

Utilizing the Installment Loan Calculator

To utilize the Installment Loan Calculator:

- In the Loan Amount Currency Box, enter the amount borrowed or the amount remaining on the loan.

- Using the dropdown menu, select the desired units for the loan term. Selecting one of these options will display a corresponding number spinner.

- The Loan Term can be entered in months or years. By default, Loan Terms in Months is selected.

- Selecting the Loan Term in Months option will display a Number Spinner that increases and decreases in increments of 12.

- Selecting the Loan Term in Years option from the Dropdown displays a number spinner that increases and decreases by one.

- The Loan Term can be entered in months or years. By default, Loan Terms in Months is selected.

- Enter the desired loan term in the Number Spinner Box by either clicking the up and down arrows or by typing a number in the box.

- Select the Estimated Credit Score Dropdown Box to select the appropriate credit score range.

- After the required fields have been completed, select Calculate.

- This will populate the Monthly Payment and Interest Rate in the results fields below.

- This will populate the Monthly Payment and Interest Rate in the results fields below.

College Cost Estimator

Glossary of Terms

| Term | Description |

|---|---|

| College Cost Increase Rate | The percentage by which the annual tuition cost will be increased. An increase rate of 5% is recommended. |

| Interest Rate | The annualized return on investment for a college education. This value is a ratio of the financial benefit or return to the cost of attendance and is provided as a percentage. The rate of return is impacted by factors such as institution type, tuition cost, and area of study. An annual rate of return of 5% is recommended, but this field is optional. |

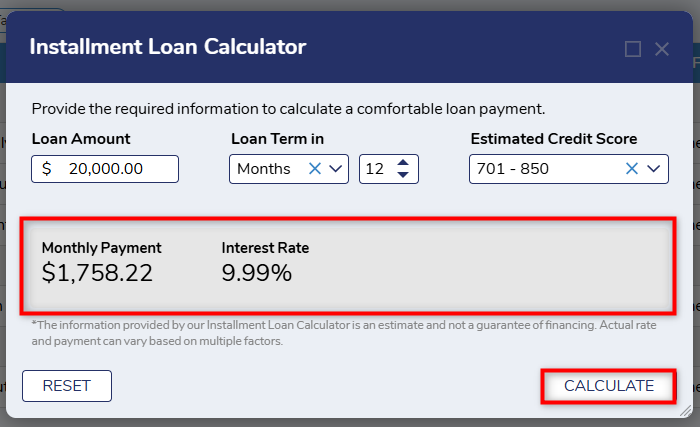

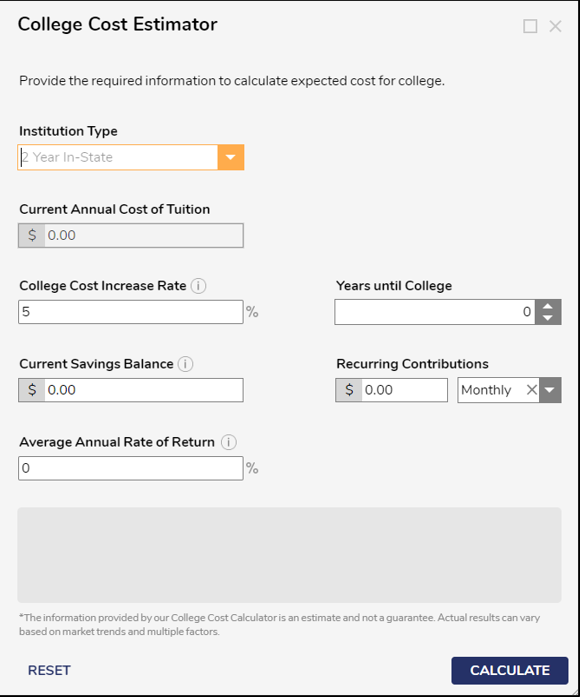

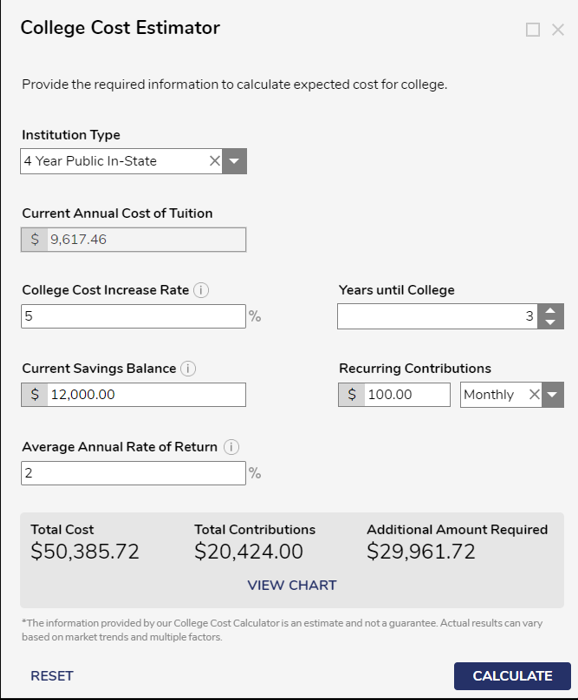

College Cost Estimator Flow

This Flow runs the College Cost Estimator, which allows End Users to compute their total cost of tuition, total contribution towards tuition, and remaining costs based on their institution type, start year, increase rate, savings, and other expected contributions.

Utilizing the College Cost Estimator Calculator

To utilize the College Cost Estimator Calculator:

- Select the type of college the student will be attending using the Institution Dropdown.

- Available options include 2 Year-In-State, 2 Year-Out-of-State, 4 Year In-State, 4 Year-Out-of-State, 4 Year Private, and Custom. Selecting one of these options will populate the Current Annual Cost Tuition Currency Box, allowing End Users to provide their tuition for the current year.

- Selecting the Custom option will allow End Users to provide their tuition value. In the Custom Cost of Tuition Currency Box, enter the current annual tuition for the student's expected college.

- In the Years in College number spinner, enter the number of years that the student will likely be enrolled in college.

- Available options include 2 Year-In-State, 2 Year-Out-of-State, 4 Year In-State, 4 Year-Out-of-State, 4 Year Private, and Custom. Selecting one of these options will populate the Current Annual Cost Tuition Currency Box, allowing End Users to provide their tuition for the current year.

- Enter the annual tuition increase percentage in the College Cost Increase Rate Number Box.

- Enter the number of years until the student will be starting college.

- The College Cost Estimator can account for college savings funds and recurring contributions as well as determining how much additional funding will be needed to finance the student's college education. The following steps are required to include savings and additional contributions:

- In the Current Savings Balance Currency Box, enter the amount currently saved for the student's education, of the anticipated amount that will be contributed towards college costs. This field is optional.

- To account for recurring monthly or yearly contributions, enter the amount that will be contributed to the Recurring Contributions Currency Box and select how often the contribution will be made by selecting an option from the Dropdown. Recurring contributions can be made on a monthly or yearly basis. The Recurring Contributions fields are optional.

- In the Average Annual Rate of Return Number Box, enter the expected return on investment for the college education as a percentage.

- After the required fields have been completed, select Calculate. This action will populate the Total Cost, Total Contributions, and Additional Amount Required in the results field. If no contributions have been specified in the Current Savings Balance and Recurring Contributions fields, the total contributions value will be $0.00 and the Additional Amount Required will be equivalent to the Total Cost.

- Selecting the Calculate button will also reveal the View Chart button. This action will direct End Users to another form that displays the College Cost and Contributions Bar Chart.

- The College Cost Estimator Bar Chart shows the amount of principal Yearly Contributions, and Yearly Cost.

- Clicking the Close button will end the Flow.

- Selecting the Back button will return End Users to the Calculator Form.

- Selecting the Reset button will clear all Form fields.

Home Affordability Calculator

Glossary of Terms

| Term | Definition |

|---|---|

| Loan Term | Depending on the User's selection, they can provide terms in months or in years to pay off the provided loan amount in. |

| Type of Financing | The type of loan a User has to finance a loan. Conventional, FHA, VA are the initial options that the calculator supports out of the box. Users can add more to this list and then update the paired Truth Table. |

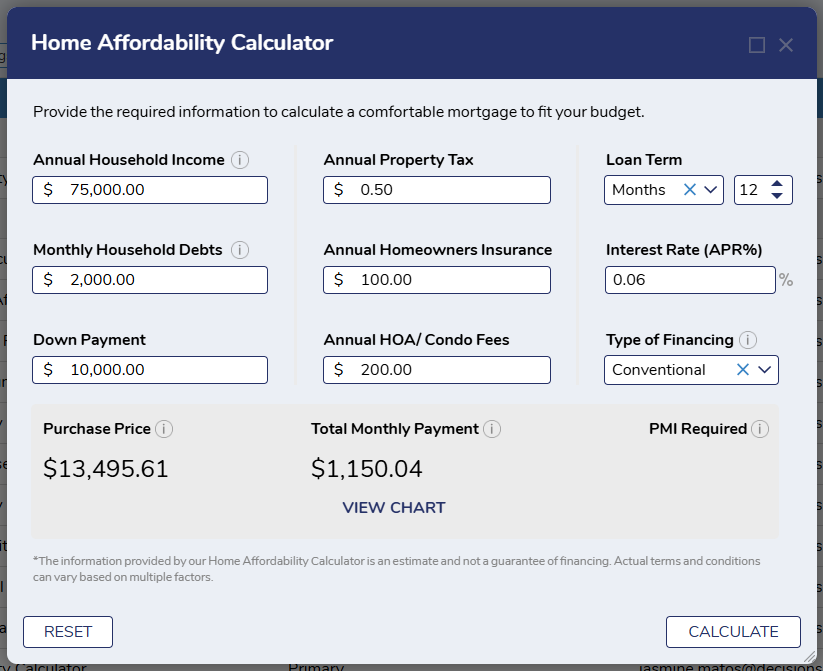

Home Affordability Calculator Flow

This Flow runs the Home Affordability Calculator form, which allows End Users to compute their purchase price, total monthly payment, and the PMI(Private Mortgage Insurance).

.png)

Utilizing the Home Affordability Calculator Flow

To utilize the Home Affordability Calculator:

- Enter the total gross income before taxes, received within 12 months in the Annual Household Income Currency Box.

- Then, in the Monthly Household Debts Currency Box, enter all liabilities of households (including non-profit institutions serving households) that require payments of interest or principal.

- In the Down Payment Currency Box, enter the initial payment amount.

- In the Annual Property Tax Currency Box, enter the annual amount that you paid to the government.

- In the Annual Homeowner's Income Currency Box, enter the annual income of the home.

- In the Annual HOA/Condo Fees Currency Box, enter the annual recurring fee that you pay to the organization. This field is optional.

- Select the desired units for the loan term using the dropdown options. Selecting one of these options will display a corresponding number spinner. The loan term can be entered in either months or years. By default, Loan Term in Months is selected.

- Selecting the Loan Term in Months option will display a number spinner that increases and decreases in increments of 12.

- Selecting the Loan Terms in Years option from the Dropdown displays a number spinner that increases and decreases by 1.

- Enter the desired loan term in the Number Spinner Box by either pressing the up and down arrows or by typing a number into the box.

- In the Interest Rate (APR%) Number Box, enter the amount of interest applied to the outstanding balance annually.

- In the Type of Financing dropdowns, select any type of loan that you have to finance.

- After all the required fields have been entered, select Calculate. This action will populate the Purchase Price, Total Monthly Payment, and PMI in the results fields below.

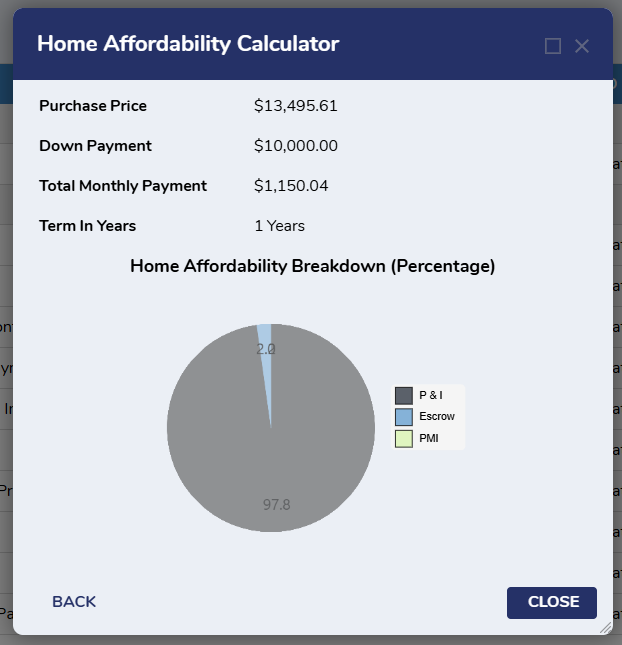

- Upon using the Calculate button, the View Chart button will be revealed. Clicking this button will redirect End Users to another form that contains a pie chart, which displays the Home Affordability breakdown.

- If End Users enter any inaccurate information which is different from the market standards, then the Form will show specific validation related to each field.

- Clicking the Back Button will return End Users to the Calculator Form.

- Clicking the Reset Button will clear all Form Fields.

Amortization Calculator

Glossary

| Term | Definition |

|---|---|

| Amortization | This calculation returns total payback and total interest when Users enter their loan amount, APR%, and loan start date. |

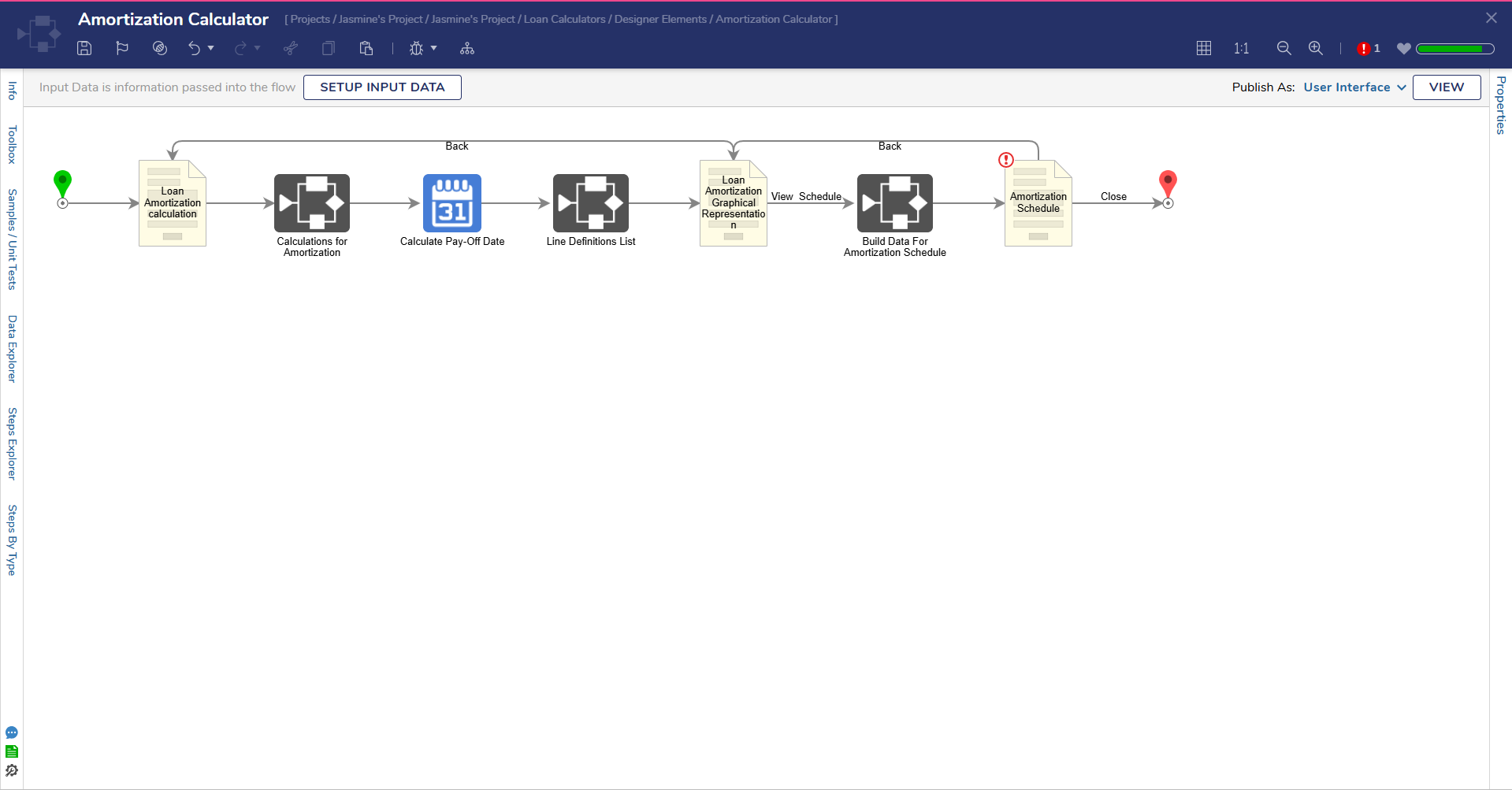

Amortization Calculator Kickoff Flow

This Flow runs the Amortization Calculator Form, which allows End Users to compute their total payback and total interest by giving inputs such as loan amount, interest rate, and term in months.

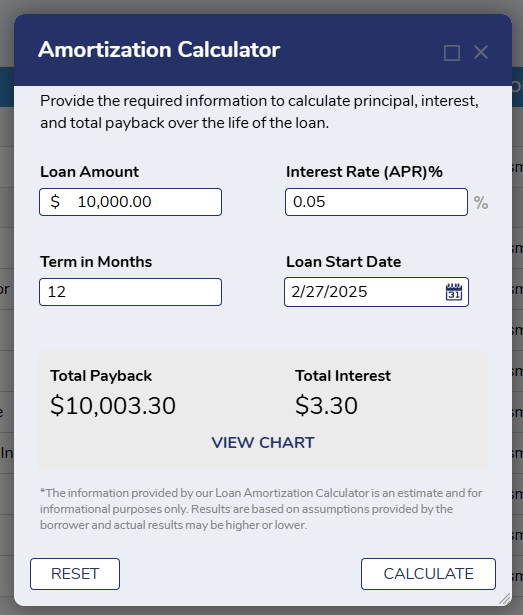

Utilizing the Amortization Calculator

To utilize the Amortization Calculator:

- Enter the amount taken as a loan in the Loan Amount Currency Box.

- In the Interest Rate Number Box, enter the current interest rate for the market.

- Enter the period of the loan in the Term in Months box.

- By default, the Form will always indicate the current date, but End Users can enter the start date of the loan in the Loan Start Date box.

- After the required fields have been entered, select Calculate. This action will populate Total Payback and Total Interest in the results fields below.

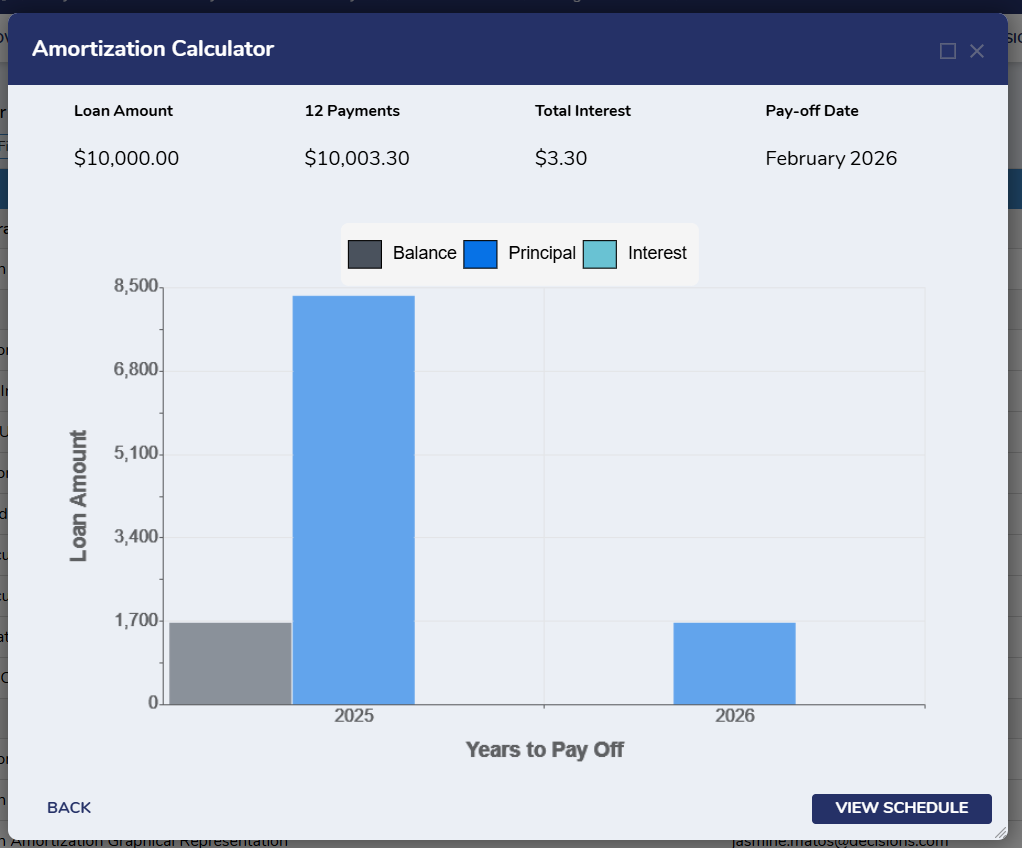

- After the Calculate button is clicked, the View Chartbutton will be revealed. Clicking this button will redirect End Users to another form that contains the bar chart.

- The Loan Amortization Bar Graph shows the amount of interest and amount of principle and payback that will be paid over the repayment period.

- The Loan Amortization Bar Graph shows the amount of interest and amount of principle and payback that will be paid over the repayment period.

- Users can select the Reset button to reset all entered values and enter new information.

- When Users select the Reset button, the labels in the result grid and View Chart button will be hidden.

- After the Calculate button is clicked, the View Chartbutton will be revealed. Clicking this button will redirect End Users to another form that contains the bar chart.

Specific validations will be shown to End Users depending on the data entered on the Form.

- If End Users do not enter any information for the Loan Amount but still select Calculate, the Form will provide the following validation in the Currency Box:

- "Loan Amount must be provided"

- If End Users do not enter any information for the APR% but still select Calculate, the Form will provide the following validation in the Interest Rate Box:

- "Interest Rate must be provided"

- If End Users do not enter any information for the Terms in Months, the Form will provide the following validation in the terms in months Number Box:

- "Terms in months must be provided"

- Clicking the Back button will return End Users to the Calculator Form.

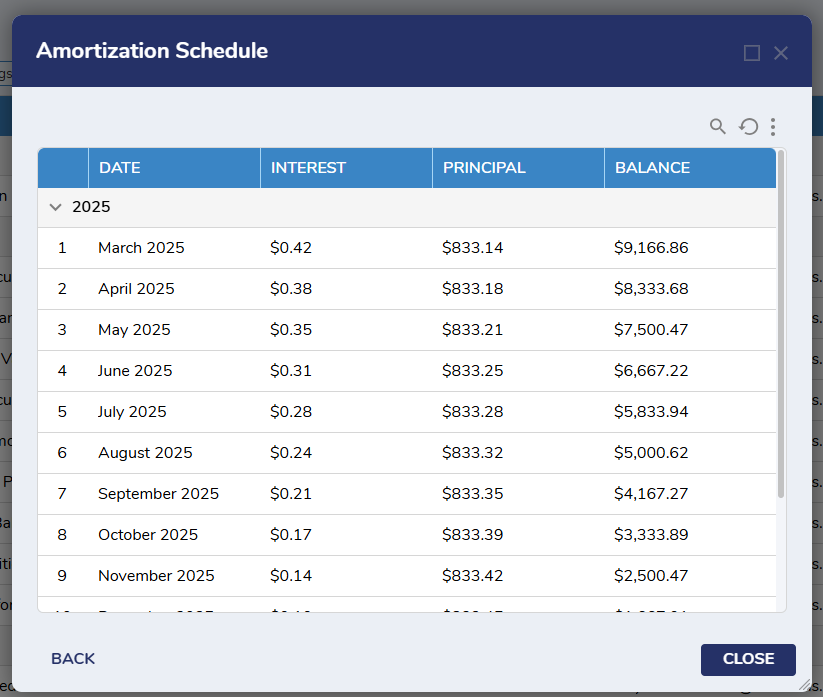

- Clicking View Schedule will display the Amortization Schedule Data.

- Clicking the Close button will end the Flow.

Debt Consolidation Calculator

Embedding Forms

To utilize the Run Debt Consolidation Calculator Flow correctly, please view our documentation on Embedding Forms. This allows a Form to be used in an external page.

Running a Flow from a URL

The Debt Consolidation Calculator Flow and the Compute Debt Consolidation Loan Flow can both be run from a URL. For more information, please view our documentation on Running a Flow from a URL.

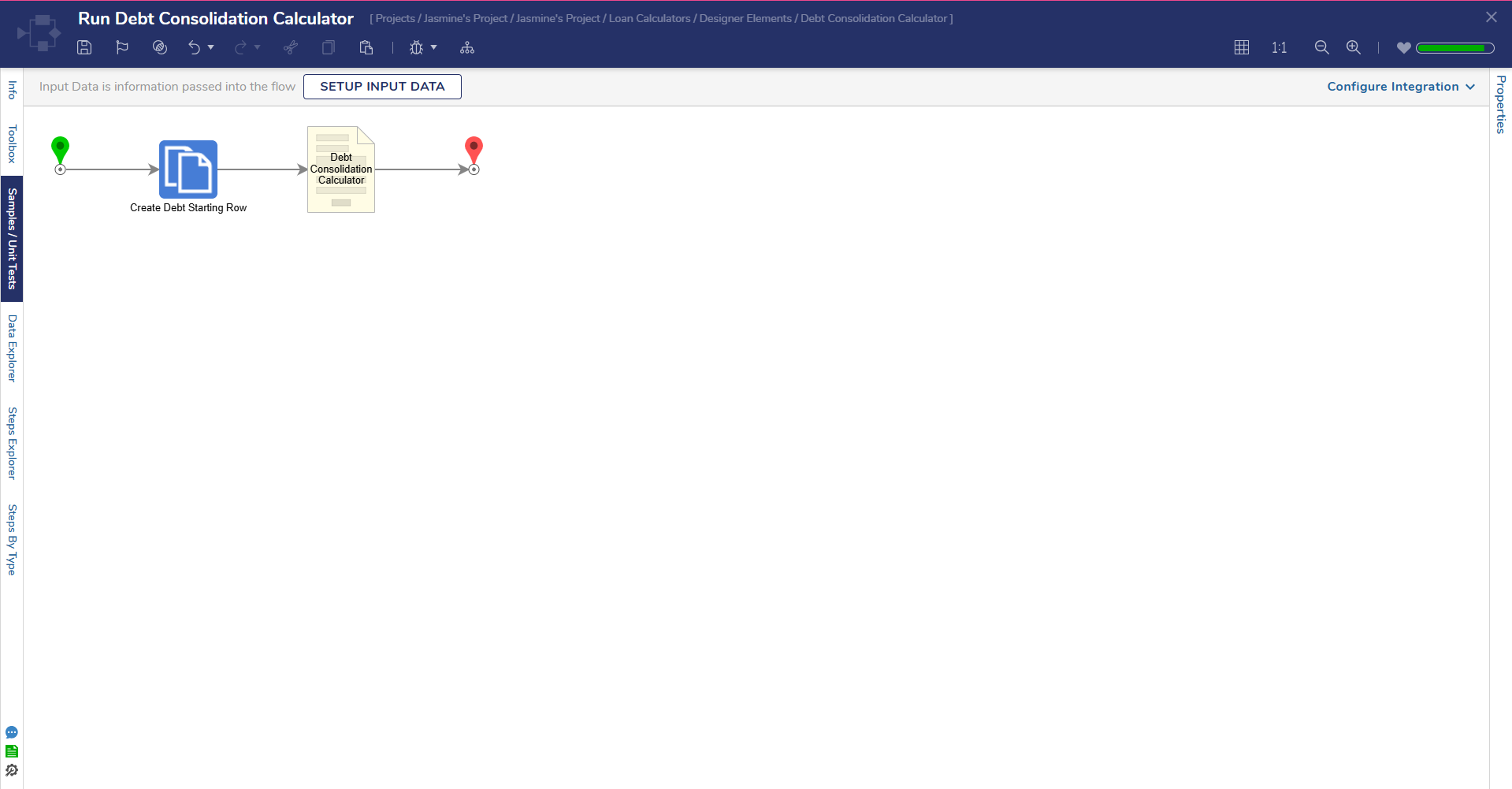

Debt Consolidation Calculator Form Flow

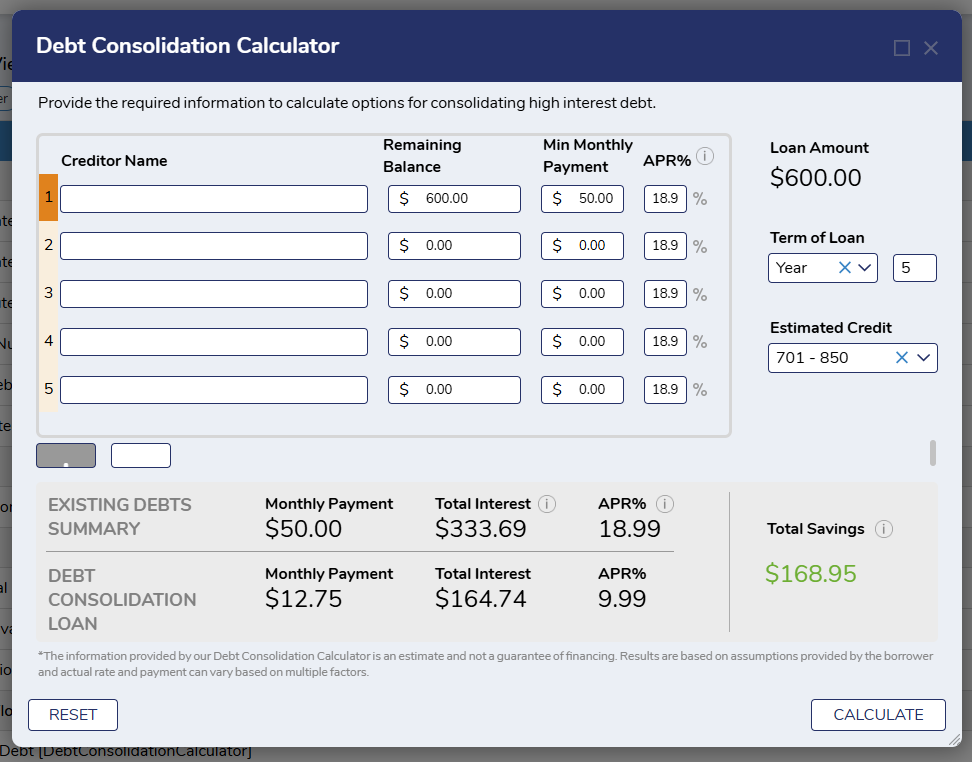

This Flow runs the Debt Consolidation Calculator Form, which allows End Users to compute their total savings using a Debt Consolidation Loan versus the User's current main debts by giving the inputs such as remaining balance, Min Monthly Payment, APR%, Term, and Credit Score range to the calculator.

Utilizing the Deb Consolidation Calculator

To utilize the Debt Consolidation Calculator:

- End Users can enter the amount of Debt in the Remaining Balance box. Debts must have a remaining balance and monthly payment. Creditor name and APR information is not required, however, if the APR field is left blank, a default value of 18.99% will be used.

- Debts can be added using the plus and minus icons located underneath the debts.

- The plus icon adds a new row to enter values of a debt.

- The minus icon removes the selected debt. The selected debt will be highlighted in orange to the left of the fields.

- As debt balances are entered, the Loan Amount will update automatically.

- Next, End Users must choose the Terms of Loan. Depending on the User's selection, terms can be provided in months or years.

- End Users will need to provide their Estimated Credit.

- The Estimated Credit is a rough estimate of the End User's credit score. End Users can choose from a range of credit scores to provide this information.

- After all the required fields have been completed, select Calculate. This action will populate the Existing Debts Summary and Debt Consolidation Loan Values in the results fields below.

Specific Validations will be shown to End Users depending on the data that is entered on the Form.

- If End Users do not enter information for the Term before selecting Calculate, the Form will show the following validation:

- "Must Provide Term to Calculate Debts"

- If End Users do not enter information for Estimated Credit before selecting Calculate, the Form will show the following validation:

- "Must Provide Credit Score Range to Calculate Debts"

- If End Users do not enter any values for the Remaining Balance and the minimum Monthly Payment before selecting Calculate, the Form will show the following validation.

- For Remaining Balance: "Please Provide Balance"

- For Min Monthly Payment: "Please Provide Monthly Payment"