The Debt Consolidation Calculator empowers customers to quickly and accurately determine options for borrowers to consider to reduce high-interest debt. Eliminate the use of unreliable and subjective web data that can damage credibility to unlock borrowing potential by easily integrating our Debt Consolidation Calculator into your current LOS or Core systems.

Prerequisites

- Users should have the Error Handling Accelerator installed before utilizing this Accelerator.

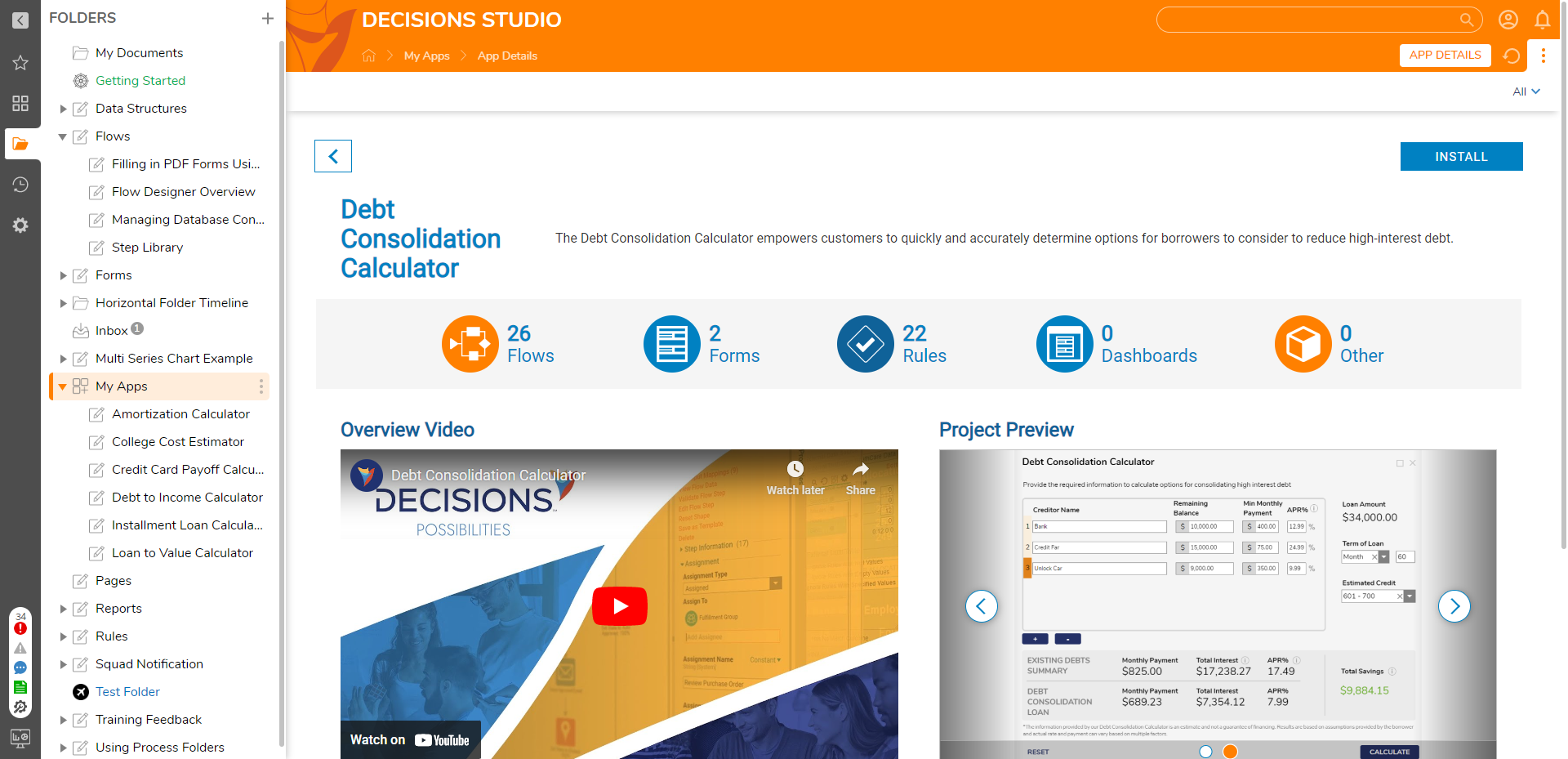

Installing App Store Applications

- Navigate to the App Store in the Folders tab.

- Search for the Debt Consolidation Calculator in the Not Installed section and select Details.

- On the App Details Page, select INSTALL.

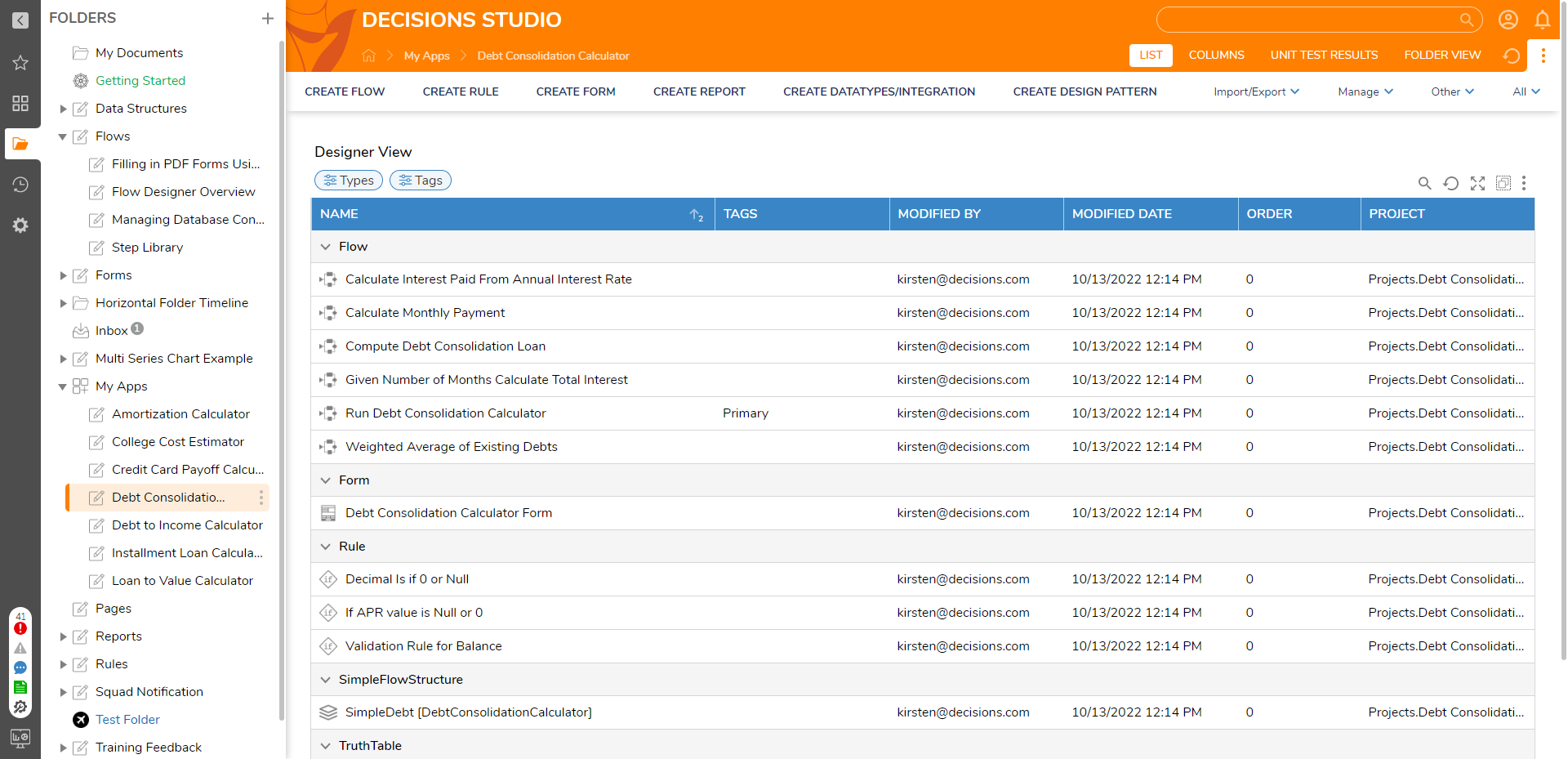

What's Included

Below is a list of items included in the Application. Hidden items are marked with an asterisk.

Flows

- Run Debt Consolidation Calculator [Primary Flow]

- Calculate Interest Paid From Annual Interest Rate

- Calculate Monthly Payment

- Compute Debt Consolidation Loan

- Given Number of Months Calculate Total Interest

- Weight Average of Existing Debts

- * [AFF] Calculate Existing/Debt Consolidation

- * [AFF] Calculate Total Loan

- * [AFF] Reset Debt Consolidation Calculator

- * [AFF] Validations for Balance & Monthly Payment

Forms

- Debt Consolidation Calculator Form

- Debt Consolidation Simple Debt Repeater

Rules

- Decimal is if 0 or Null

- If APR Value is Null or 0

- Validation Rule for Balance

- Estimated Credit Score Rate (Truth Table)

Glossary of Terms

| Term | Description |

|---|---|

| Remaining Balance | The total remaining amount that needs to be paid. |

| Min Monthly Payment | Minimum amount to be paid to the Biller. |

| APR % | Amount of interest applied to the outstanding balance. |

| Loan Amount | Total Loan Amount. |

| Terms of Loan | The length of the loan options is in months or years. |

| Estimated Credit | The borrower's estimated credit score is used to find the appropriate interest rate. |

| Existing Monthly Payment | The amount that is currently being paid per month. |

Configuration

No additional setup is required once the application is installed. Follow the below sections on Implementation to embed or run from a URL as a service.

Embedding the Form

The Form can be used on an external page. Follow the article on Embed a Form in a Web App to achieve this implementation.

Run the Flow from a URL

Flows can be run using a URL. This can be accomplished on the Primary Flow Debt Consolidation Calculator. Follow the Running a Flow from a URL article to achieve this.

Debt to Income Calculator Flow [Primary Flow]

- Debt must be entered in the left box; these debts must have a remaining balance and a monthly payment. The Creditor name and APR are not required, but if the APR is left blank, the default APR of 18.99% will be used.

- Remaining Balance: Enter the remaining loan balance of the debt

- Min Monthly Payment: Min Monthly Payment paid by the borrower

- APR %: The amount of interest applied to the outstanding balance. The default APR rate is 18.99%

- To add and remove Debts, use the + and - buttons located under the Debts.

- As Debt balances are entered, the Loan Amount will update to the left of the Debts: It is the sum of the Remaining Balances for the Debts entered.

- Next, pick the Terms of Loan. Provide terms in months or years to pay off the loan amount.

- Lastly, provide the borrowers Estimated Credit: This is a rough estimate of the individuals credit score to find the interest rate.

- Select CALCULATE or hit the "Enter" key. This will populate the Existing Debts Summary and Debt Consolidation Loan Valuesin the results fields below Results

- Existing Monthly Payment: the Sum of the Min Monthly Payment of all the Debts entered.

- Existing Total Interest: The total interest is calculated on existing debts using the term selected, rates entered by the borrower, and/or the default rate of 18.99%.

- Debt Consolidation Loan Results: will display based on the Loan Amount, Term, and Estimated Credit Score range.

- The APR of this loan show is determined by the APR Truth Table, which can be easily adjusted from the studio.

- Total Savings: Total Savings is the amount of interest saved over the life of the debt consolidation loan.

- The calculator also has the RESET button, where the user can reset all the entered values and enter new information.

- When the user hits RESET, the Results in the result grid are hidden, and the calculator returns to its starting start with 5 empty Debt rows to be filled in.

Validations

- If the user did not enter any Term and hit calculate, then validation for Term will be shown on that specific number box (Must Provide Term to calculate debts.)

- If the user did not select the Estimated Credit Dropdown options and hit calculate, then validation for the Estimated Credit will be shown on that specific Combobox (Must Provide Credit Score range to calculate debts)

- If the user did not enter any value for Remaining Balance and min Monthly Payment in the data repeater, then validation will be shown to the particular currency boxes. When the user hits calculate, the result grid values shown are Existing Debts Summary and Debt Consolidation Loan