For small to mid-sized financial institutions, the Credit Card Calculator empowers customers to quickly and accurately compare repayment options for borrowers to consider when carrying high-interest debt. Eliminate the use of unreliable and subjective web data that can damage credibility to unlock borrowing potential by easily integrating the Credit Card Payoff Calculator into current LOS or Core systems.

Prerequisites

- Users should have the Error Handling Accelerator installed before utilizing this Accelerator.

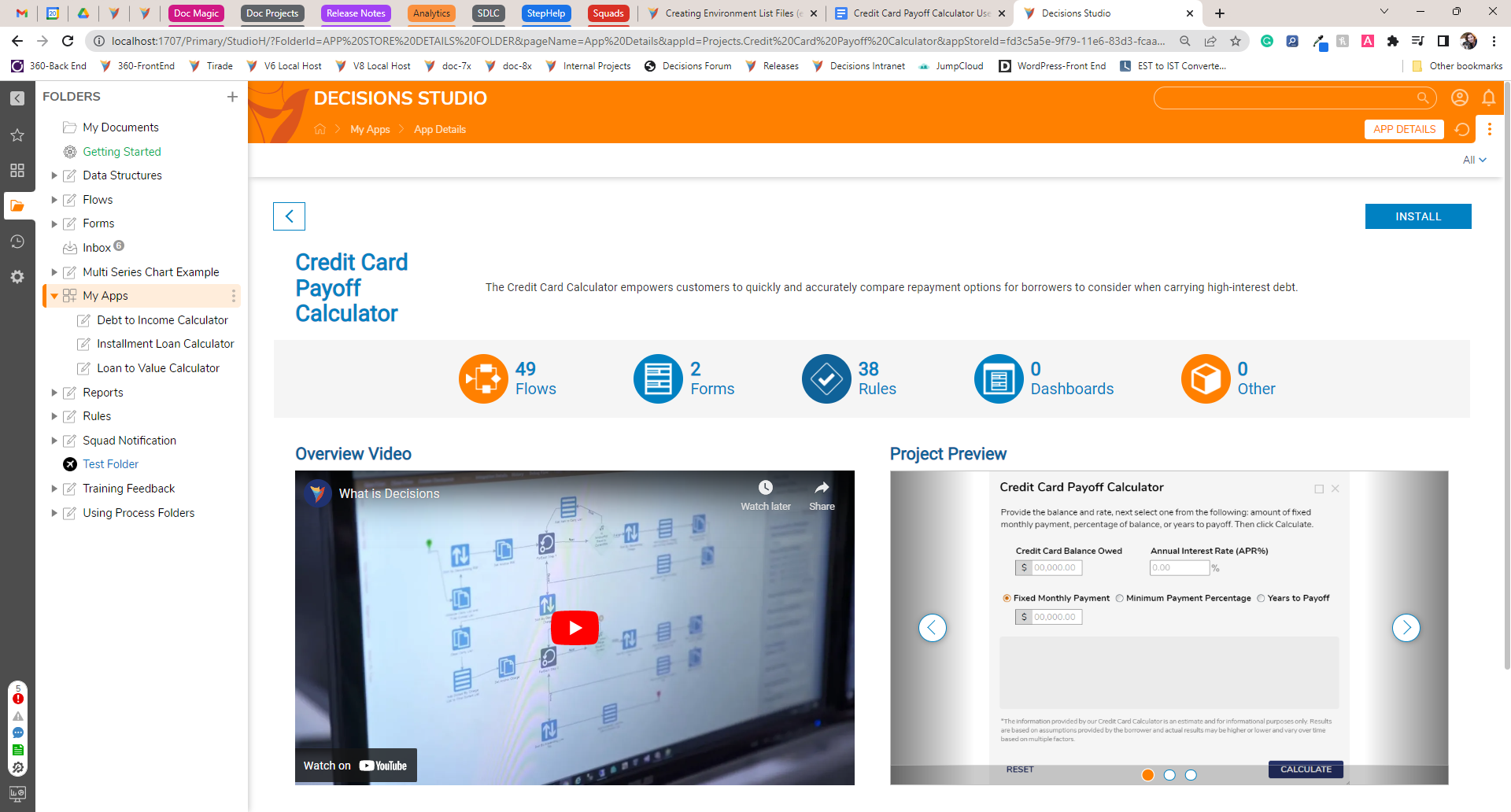

Installing App Store Applications

- Navigate to the App Store in the Folders tab.

- Search for the Credit Card Payoff Calculator in the Not Installed section and select Details.

- On the App Details Page, select INSTALL.

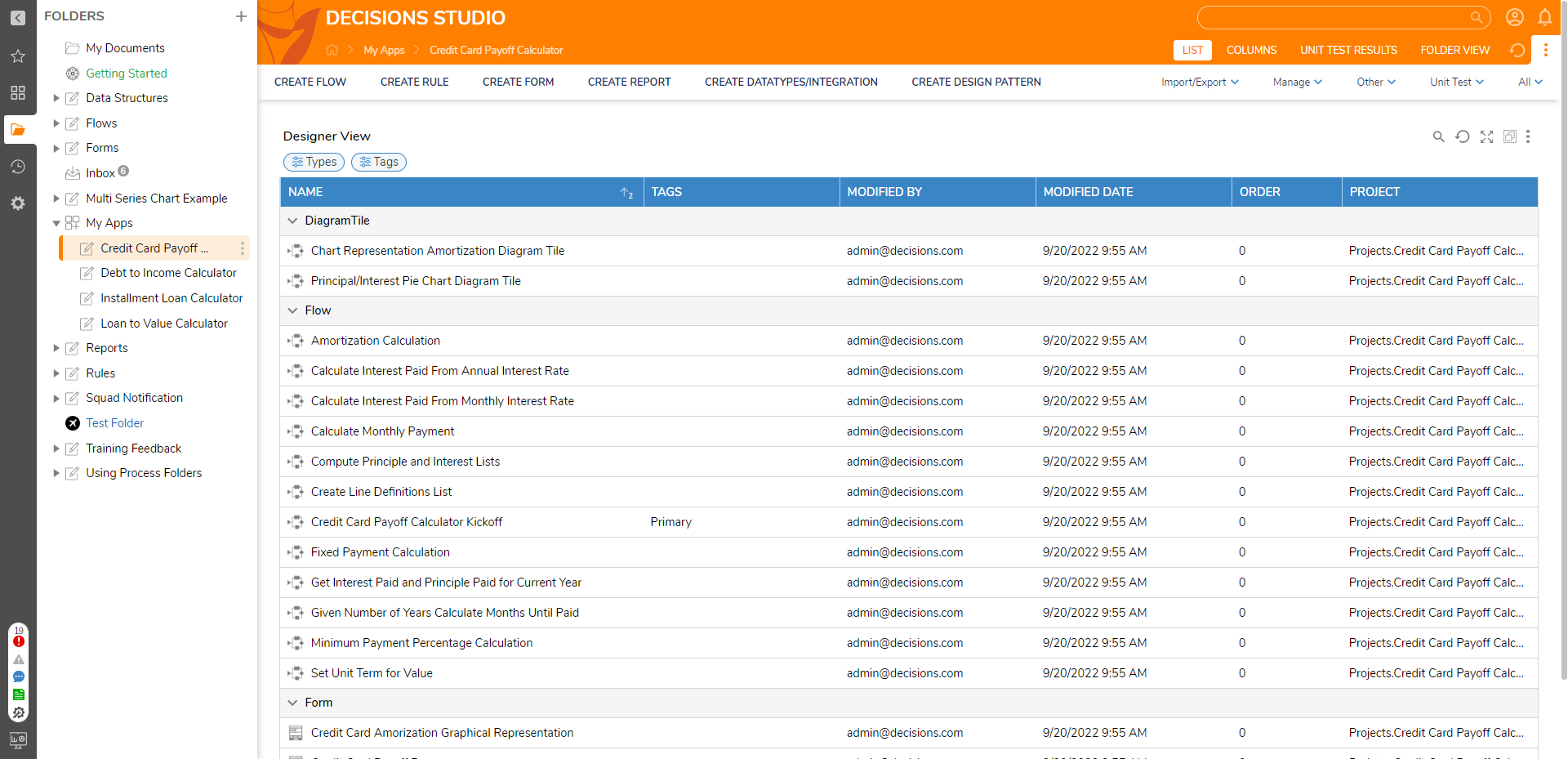

What's Included

Below is a list of items included in the Application. Hidden items are marked with an asterisk.

Flows

- Credit Card Payoff Calculator Kickoff [Primary]

- Amortization Calculation

- Calculate Interest Paid From Annual Interest Rate

- Calculate Interest Paid From Monthly Interest Rate

- Calculate Monthly Payment

- Compute Principle and Interest Lists

- Create Line Definitions List

- Fixed Payment Calculation

- Get Interest Paid and Principle Paid for Current Year

- Given Number of Years Calculate Months Until Paid

- Minimum Payment Percentage Calculation

- Set Unit Term for Value

- * [AFF] Hide/Show Type of Calculation Options

- * [AFF] Calculate Event Button

- * [AFF] Reset All Fields

- * [AFF] Show/Hide Chart Button

Forms

- Credit Card Amortization Graphical Representation

- Credit Card Payoff Form

Diagram Tiles

- Chart Representation Amortization Diagram Tile

- Principle/Interest Pie Chart Diagram Tile

Rule

- Credit Card Field Validation

- * Create Line Definitions List_Rule Collection Filter Step (Principle)

- * Create Line Definitions List_Rule Collection Filter Step (Principle) [1]

- * Create Line Definitions List_Rule Collection Filter Step (Interest)

Glossary of Terms

| Term | Description |

|---|---|

| Credit Card Balance Owed | The amount that the user has charged and not paid on the credit card |

| Annual Interest Rate (APR%) | The amount of interest applied to the outstanding balance annually |

| Minimum Payment Percentage | The percentage of the balance that the user would like to pay each month |

| Fixed Monthly Payment | The amount that the user would like to pay each month |

| Years to Payoff | The number of years that the user would like to pay the balance off in |

| Months Until Payoff | The number of months it would take for the user to pay off the credit card balance |

| Years Until Payoff | The number of years it would take for the user to pay off the credit card balance |

| Total Interest Paid | The total amount of interest that the user will pay throughout the payoff period |

Configuration

No additional setup is required once the application is installed. Follow the below sections on Implementation to embed or run from a URL as a service.

Embedding the Form

The Form can be used on an external page. Follow the article on Embed a Form in a Web App to achieve this implementation.

Run the Flow from a URL

Flows can be run using a URL. This can be accomplished on the Primary Flow Credit Card Payoff Calculator Kickoff. Follow the Running a Flow from a URL article to achieve this.

Credit Card Payoff Calculator Kickoff [Primary Flow]

This Flow runs the Credit Card Payoff Calculator Form, allowing the end user to compute their monthly payment, total interest paid, years until payoff, and months until payoff.

- In the Credit Card Balance Owned currency box, enter the outstanding balance on the credit card.

- Next, enter the Annual Percentage Rate in the percentage box.

- Select the desired type of calculation using the radio button options. Selecting one of these options will reveal a corresponding control. Fixed Monthly Paymentis selected by default.

- The Minimum Payment Percentage option will display a drop-down with percentages from 1% to 5%.

- The Fixed Monthly Payment option displays a currency box where the end user can enter the desired amount.

- The Years to Payoff option displays the number box where the end user can enter the desired years.

- Click CALCULATE. The results field will populate the Monthly Until Payoff, Years Until Payoff, and Total Interest Paid.

- When the Years to Payoff option is selected for the calculation, the results fields will include the Months Until Payoff, Monthly Payment, and Total Interest Paid.

- Upon clicking CALCULATE, the View Chart button will be revealed. Clicking this button will redirect the end user to another form that contains two charts:

- The Credit Card Repayment Bar Chart shows the amount of interest and principle that will be paid over the repayment period.

- The Principal vs. Interest Pie Chart shows what percentage of the total amount paid was interest and what percentage was principal.

- Clicking the BACK button will return the end user to the calculator form. Clicking the RESET button will clear all Form fields.