| Step Details | |

| Introduced in Version | 4.0.0 |

| Last Modified in Version | 7.12.0 |

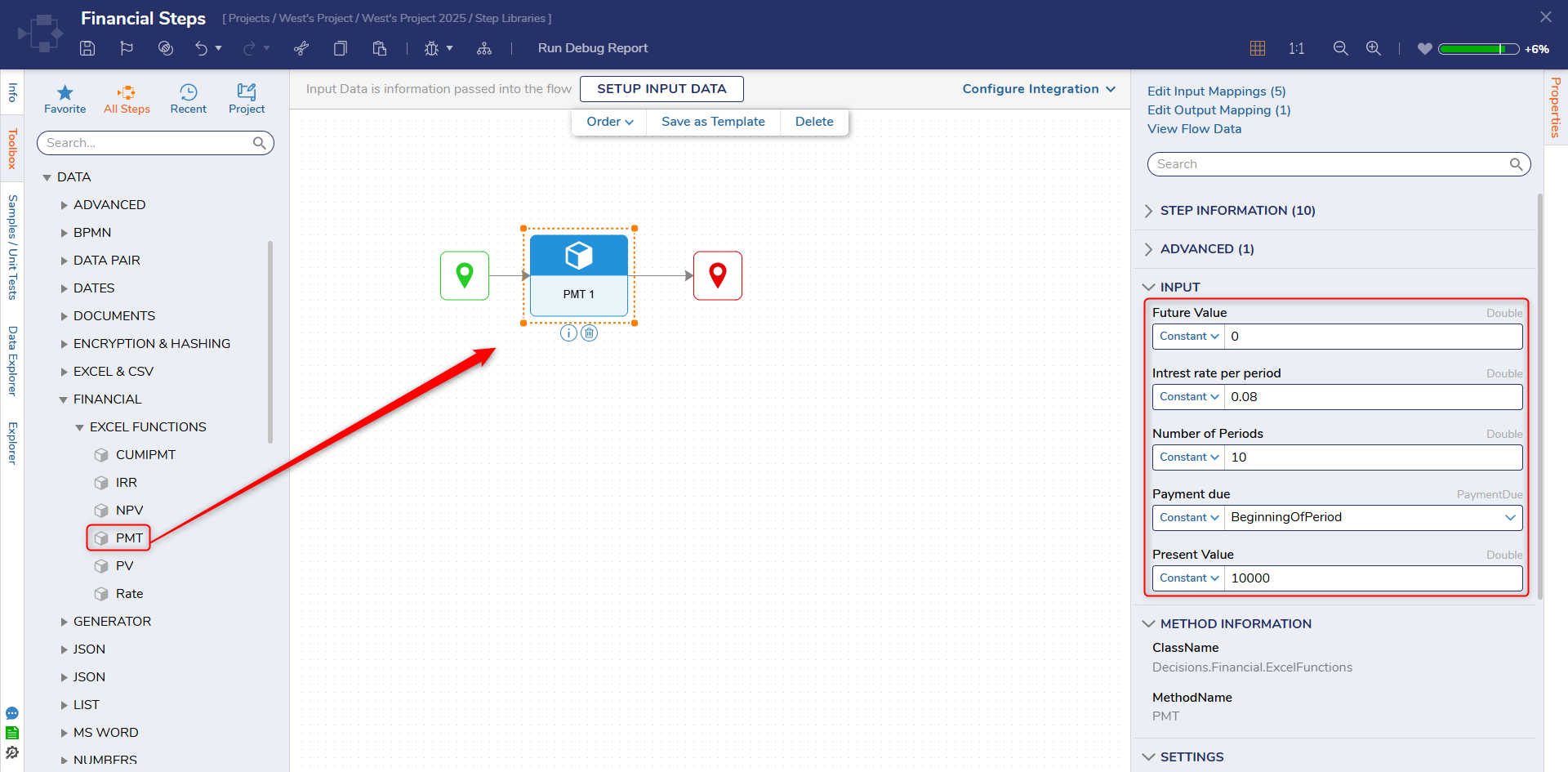

| Location | Data > Financial > Excel Functions |

The PMT step is available in the Finance module. The PMT function, which stands for "Payment," is used to calculate the payment amount at a constant interest rate and a fixed number of payments. It's commonly used in financial modeling, budgeting, and loan calculations to determine how much needs to be paid regularly to repay a loan over a specific period.

Prerequisites

This step requires the Financial module to be installed before it will be available in the toolbox.

Properties

Inputs

| Property | Description | Data Type |

|---|---|---|

| Future Value | The future value, or a cash balance after the last payment. | Double |

| Interest Rate per period | This property represents the interest rate for each period. | Double |

| Number of Periods | This property represents the total number of payment periods. It defines the duration over which cumulative interest is calculated. The number of periods can be a whole number or a decimal depending on the frequency of payments. | Double |

| Payment due | This property indicates the timing of the payment, which can be either "End of Period" or "Beginning of Period." It determines whether payments are made at the end or the beginning of each compounding period. | PaymentDue |

| Present Value | The present value represents the initial principal amount or the current value. | Double |

Outputs

| Property | Description | Data Type |

|---|---|---|

| PMT1_Output | The calculated payment amount at a constant interest rate and a fixed number of payments. | Double |

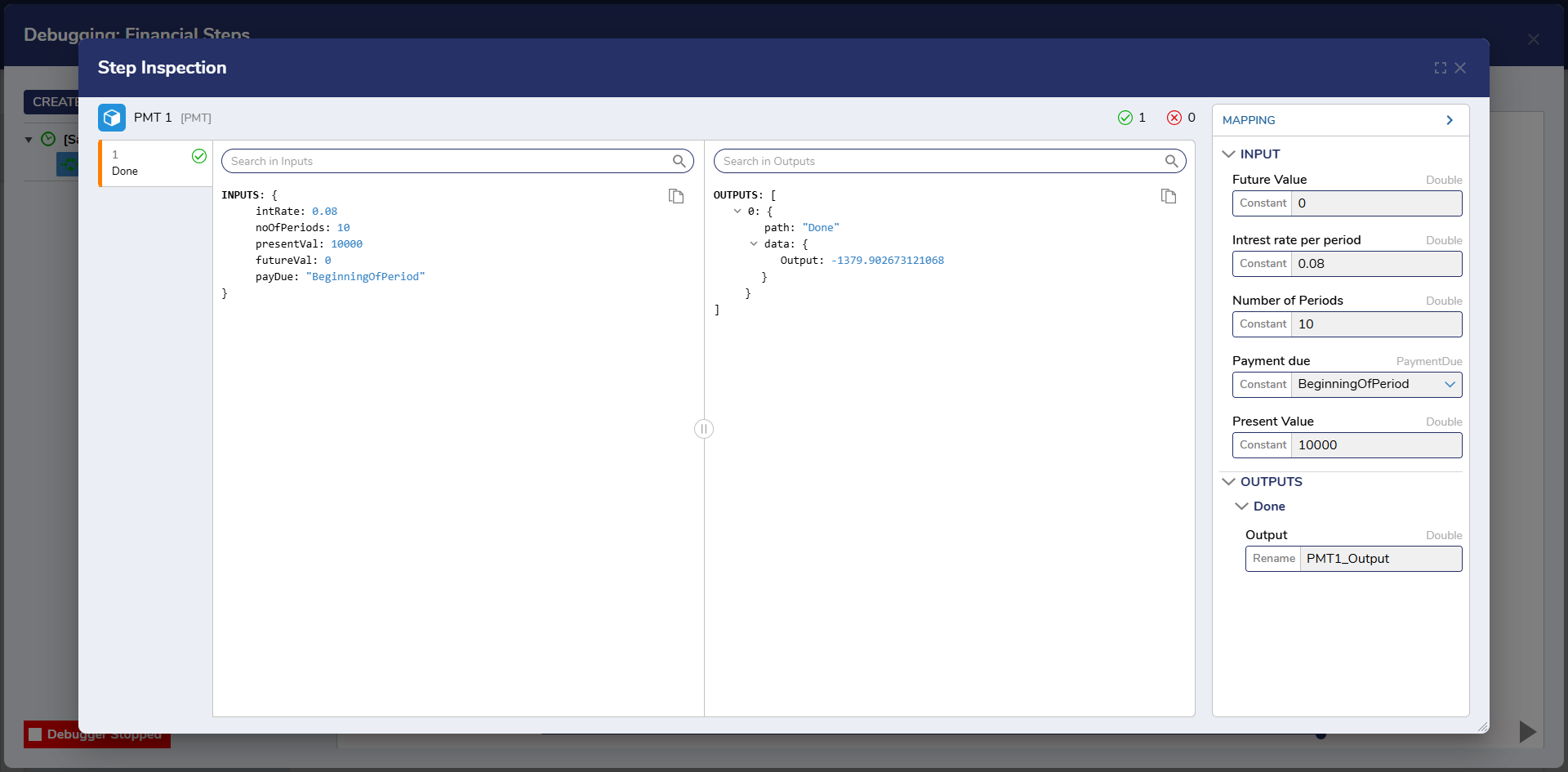

Example Inputs and Outputs

| Future Value | Interest Rate per period | Number of Periods | Present Value | Payment due | Output |

|---|---|---|---|---|---|

| 0 | 0.08 | 10 | 10000 | BeginningOfPeriod | -1379.902673121068 |

| 0 | 0.06 | 18 | 50000 | EndOfPeriod | -4617.827027643544 |

Common Errors

Invalid Inputs

If the Interest Rate per period, Number of Periods, or Present Value inputs are empty, the step will return an error. Please ensure these inputs have data mapped correctly.

Exception Message:

Exception Stack Trace: DecisionsFramework.Design.Flow.ErrorRunningFlowStep: Error running step CUMIPMT 1[CUMIPMT] in flow [Financial Module]: Exception invoking method CUMIPMT on class ExcelFunctions

---> DecisionsFramework.LoggedException: Exception invoking method CUMIPMT on class ExcelFunctions

---> System.Exception: r must be more than 0 at Excel.FinancialFunctions.Loan.calcCumipmt(Double r, Double nper, Double pv, Double startPeriod, Double endPeriod, PaymentDue pd

at Excel.FinancialFunctions.Financial.CumIPmt(Double rate, Double nper, Double pv, Double startPeriod, Double endPeriod, PaymentDue typ

at Decisions.Financial.ExcelFunctions.CUMIPMT(Double intRate, Double noOfPeriods, Double presentVal, Double startPeriod, Double endPeriod, PaymentDue payDue

at InvokeStub_ExcelFunctions.CUMIPMT(Object, Object, IntPtr*

at System.Reflection.MethodInvoker.Invoke(Object obj, IntPtr* args, BindingFlags invokeAttr)

--- End of inner exception stack trace --- at DecisionsFramework.Design.Flow.StepImplementations.InvokeMethodStep.Run(StepStartData data

at DecisionsFramework.Design.Flow.FlowStep.RunStepInternal(String flowTrackingID, String stepTrackingID, KeyValuePairDataStructure[] stepRunDataValues, AbstractFlowTrackingData trackingData

at DecisionsFramework.Design.Flow.FlowStep.Start(String flowTrackingID, String stepTrackingID, FlowStateData data, AbstractFlowTrackingData trackingData, RunningStepData currentStepData)