| Step Details | |

| Introduced in Version | 4.0.0 |

| Last Modified in Version | 7.12.0 |

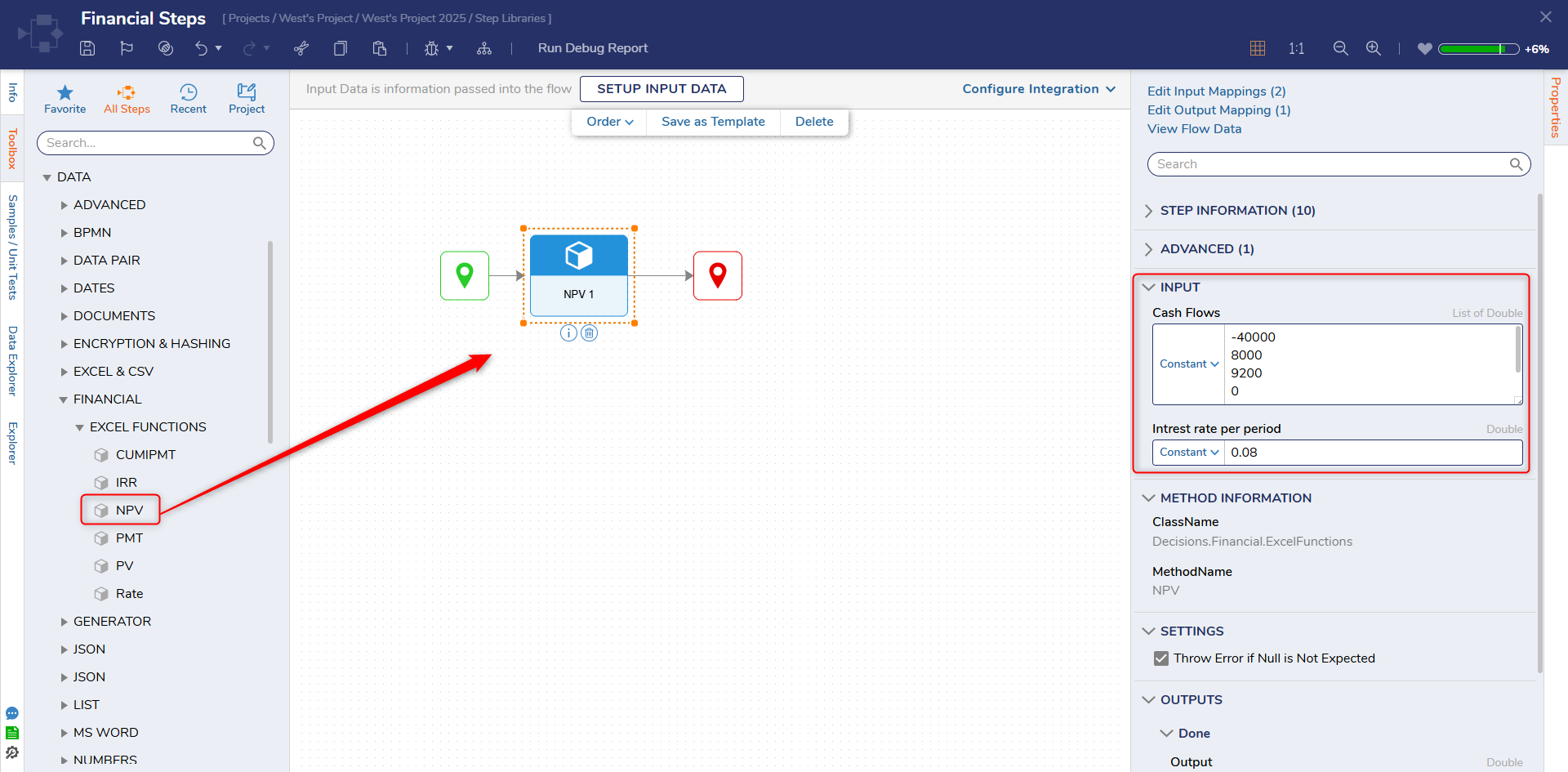

| Location | Data > Financial > Excel Functions |

The NPV step is available in the Finance module. The NPV (Net Present Value) function evaluates the profitability of an investment or a series of cash flows. It measures the value of future payments (negative values, typically representing investments or expenses) and income (positive values, typically representing returns or revenue) in today's terms by discounting them at a specified rate. The result is a single numeric value that represents the net value of the investment when considering the time value of money.

Prerequisites

This step requires the Financial module to be installed before it will be available in the toolbox.

Properties

Inputs

| Property | Description | Data Type |

|---|---|---|

| Cash Flows | An array of numbers to calculate the internal rate of return. Values must contain at least one positive value and one negative value to calculate the internal rate of return. IRR uses the order of values to interpret the order of cash flows. Enter the payment and income values in the sequence you want. Values are set to 0 if they contain text or characters. | List of Double |

| Interest rate per period | The rate of discount over the length of one period. | Double |

Outputs

| Property | Description | Data Type | |

|---|---|---|---|

| Done | |||

| Output | This value represents the net present value of the series of cash flows provided. | Double | |

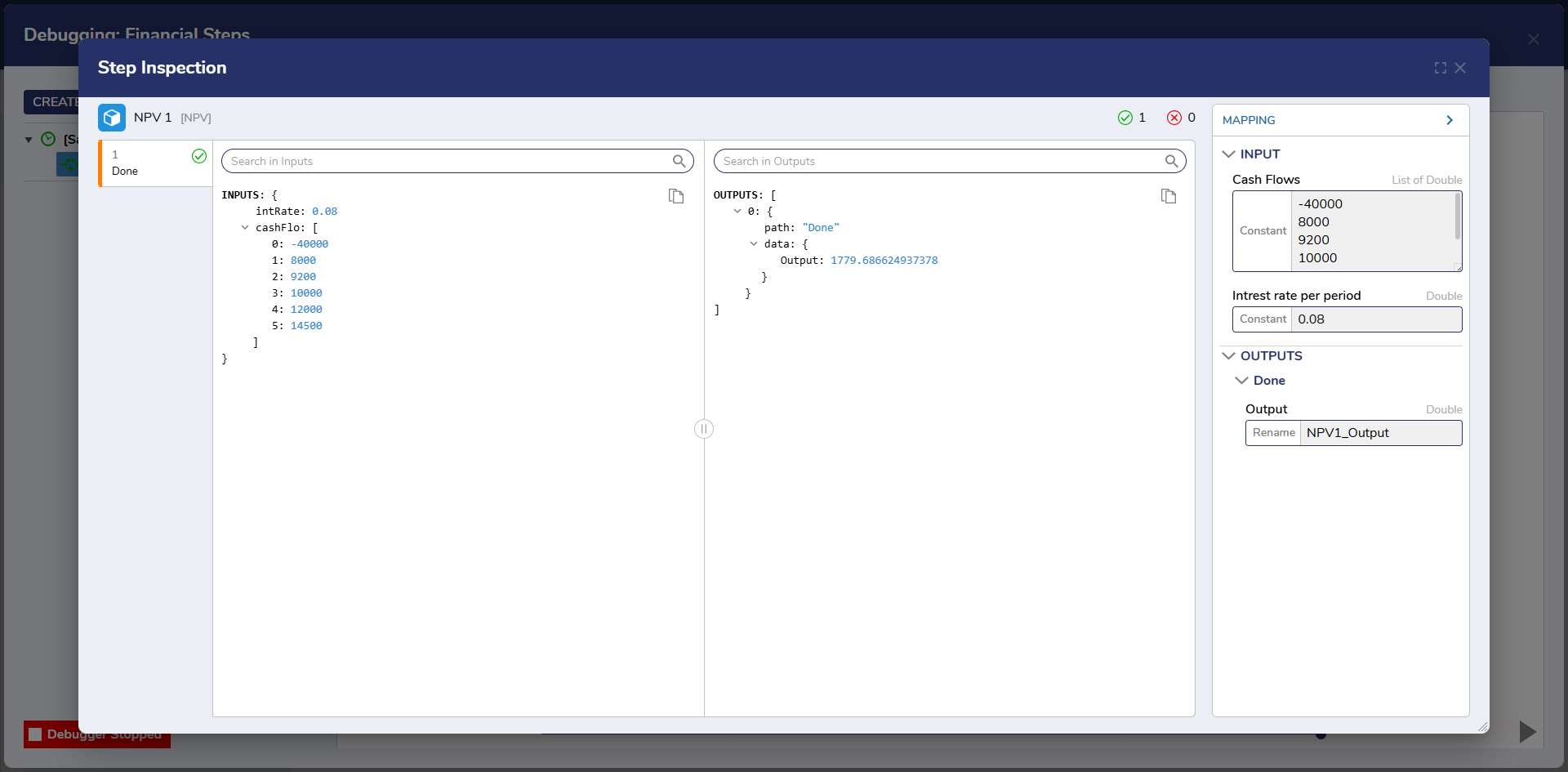

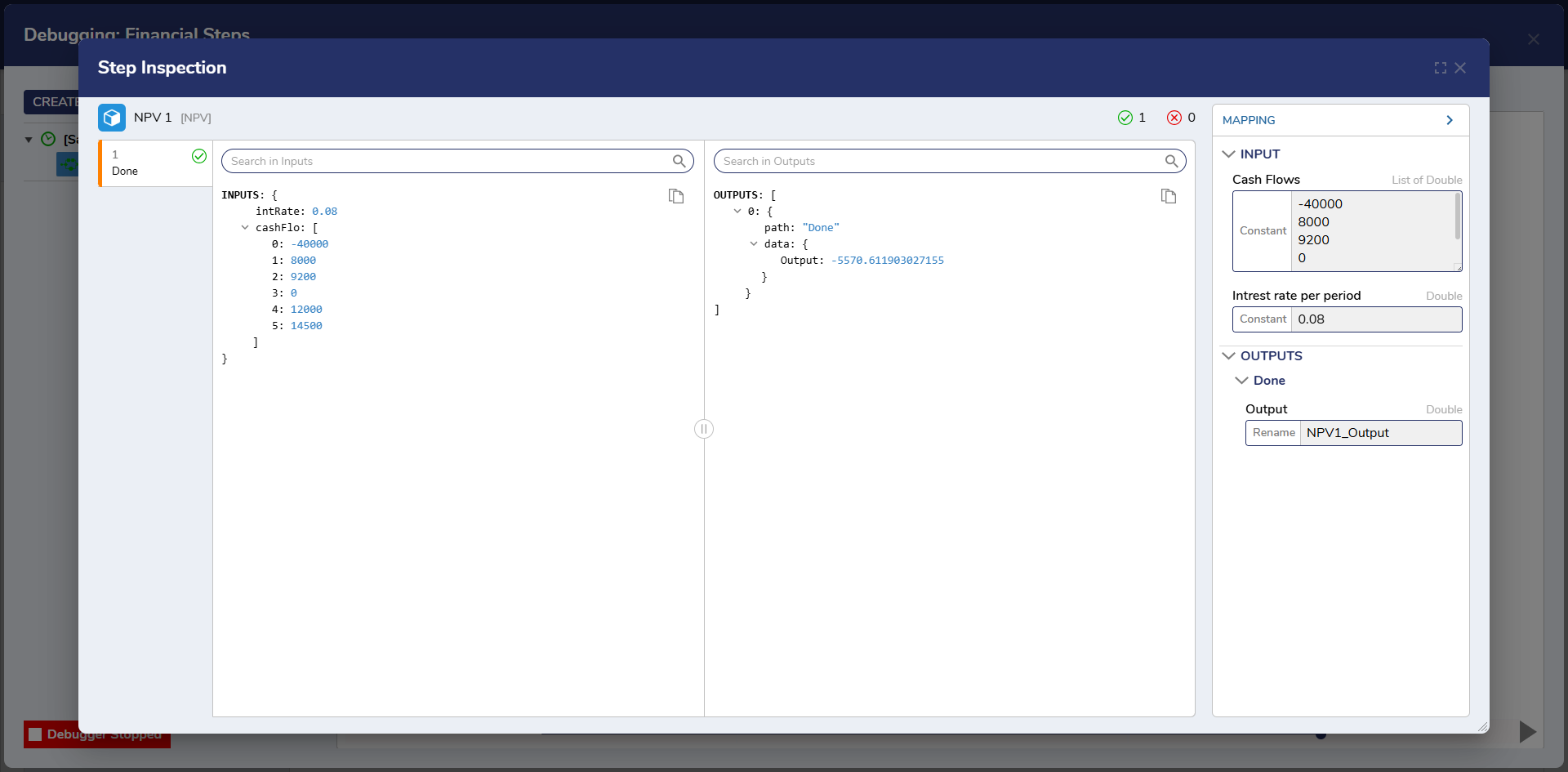

Example Inputs and Outputs

| Cash Flow | Interest rate per period | Output |

|---|---|---|

-40000 | 0.08 |  |

| -40000 8000 9200 *10000 12000 14500 | 0.08 |  |