Module Details | |

| Core or Github Module | Github |

| Restart Required | No |

| Step Location | Integration > Equifax |

| Settings Location | System > Settings > Equifax Settings |

| Prerequisites |

|

The Equifax Module allows a user to send API requests to Equifax to retrieve information such as Credit Reports.

Settings

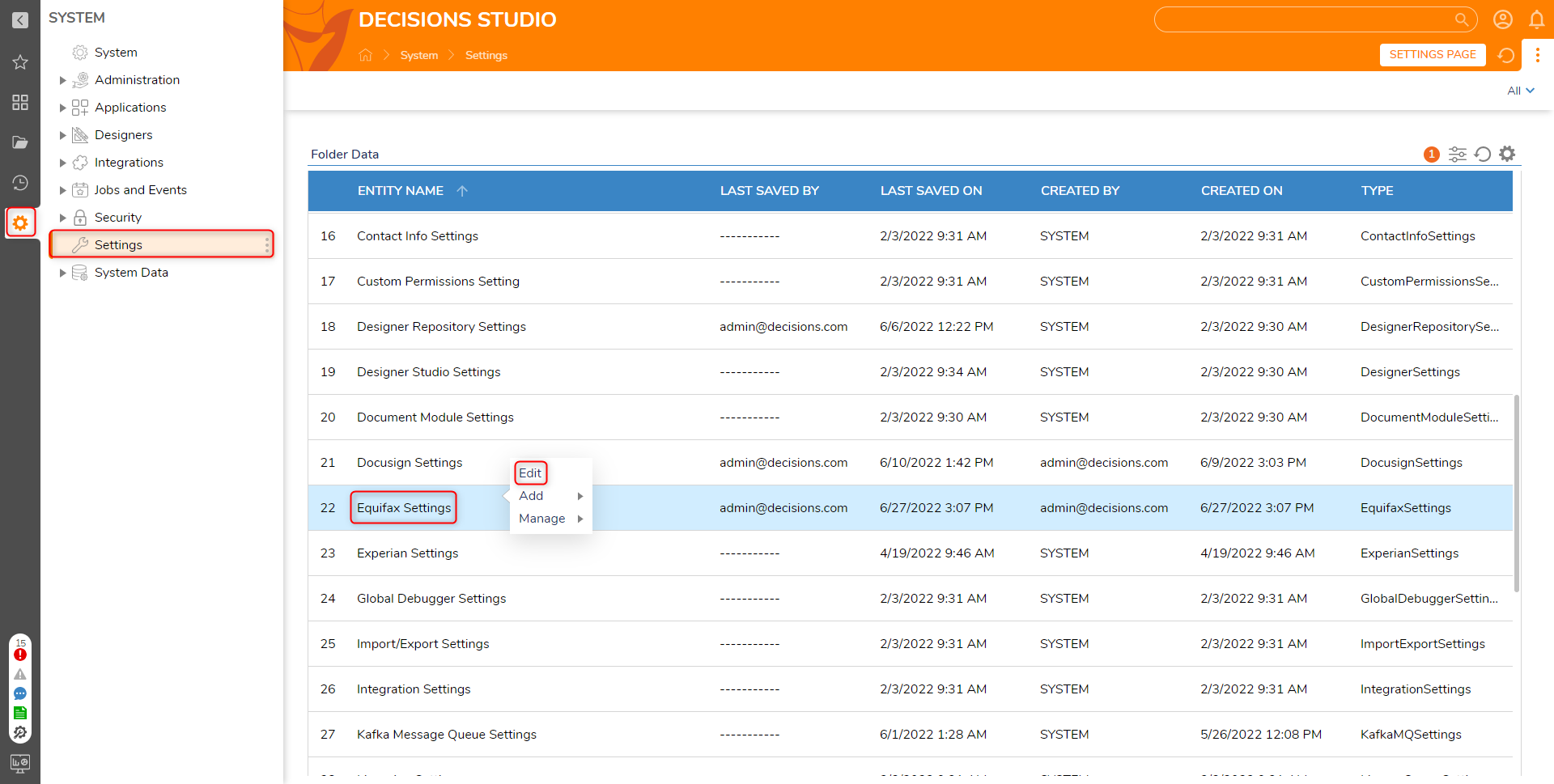

- Navigate to System > Settings. Right-click on Equifax Settings and select Edit.

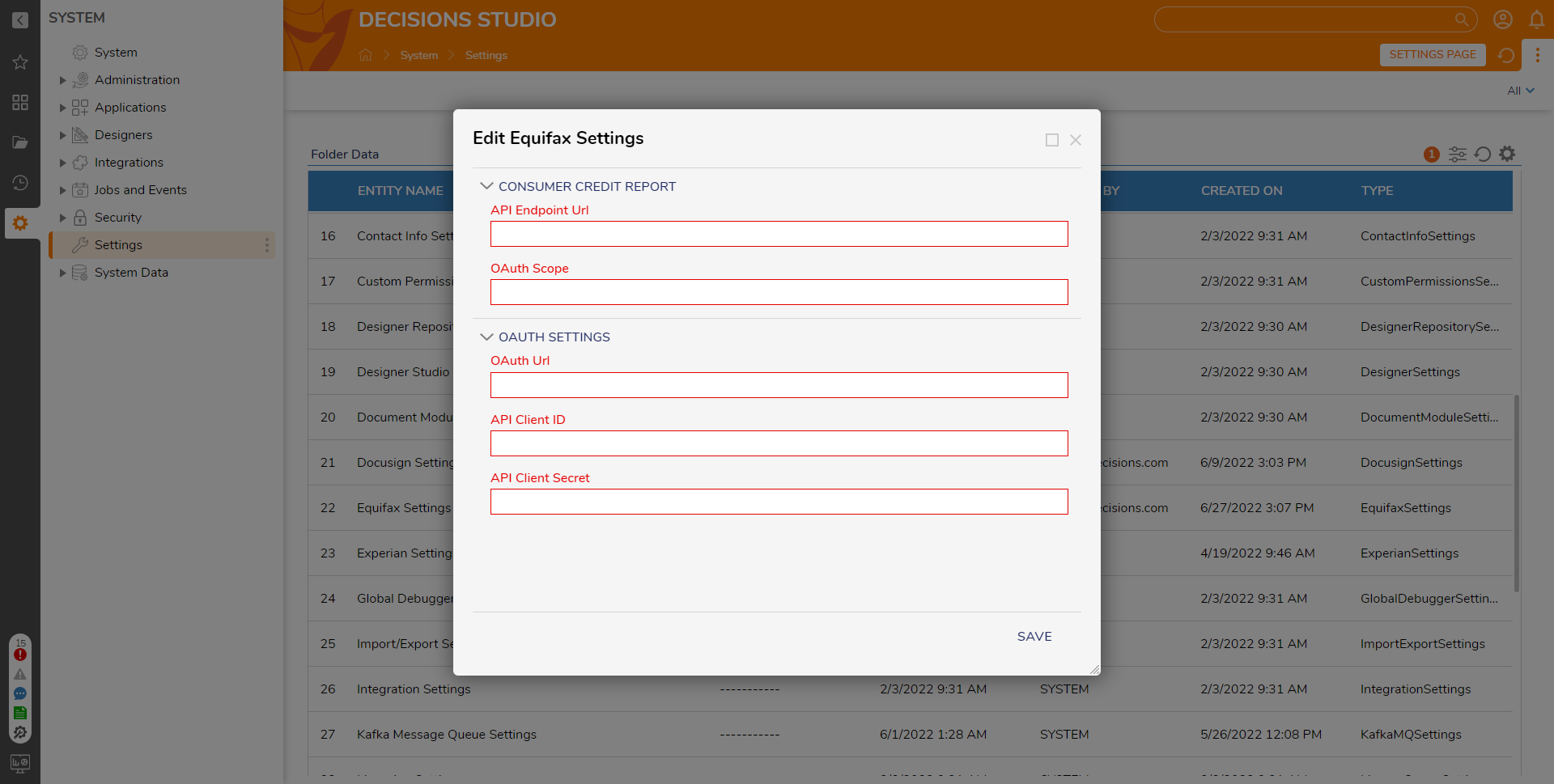

- In the Edit Equifax Settings dialog window, enter the correct configuration values and click SAVE. Values such as the API Client ID and API Client Secret can be found in Equifax's API documentation

| Setting | Description | |

|---|---|---|

| Consumer Credit Report | --- | |

| API Endpoint URL | The API Endpoint used to receive OAuth Tokens from Equifax. | |

| OAuth Scope | The OAuth Scopes that are being requested | |

| OAuth Settings | --- | |

| OAuth Url | The OAuth URL where the token request will be received by Decisions | |

| API Client ID | The API Client ID for the developer account on Equifax | |

| API Client Secret | Thr API Client Secret key for the developer acconunt on Equifax | |

Get Consumer Credit Report

The Get Consumer Credit Report step sends a request to the associated Equifax endpoint to retrieve a consumer credit report.

| Inputs | Description |

|---|---|

| Request | The values sent to the endpoint in order to retrieve a credit report. |

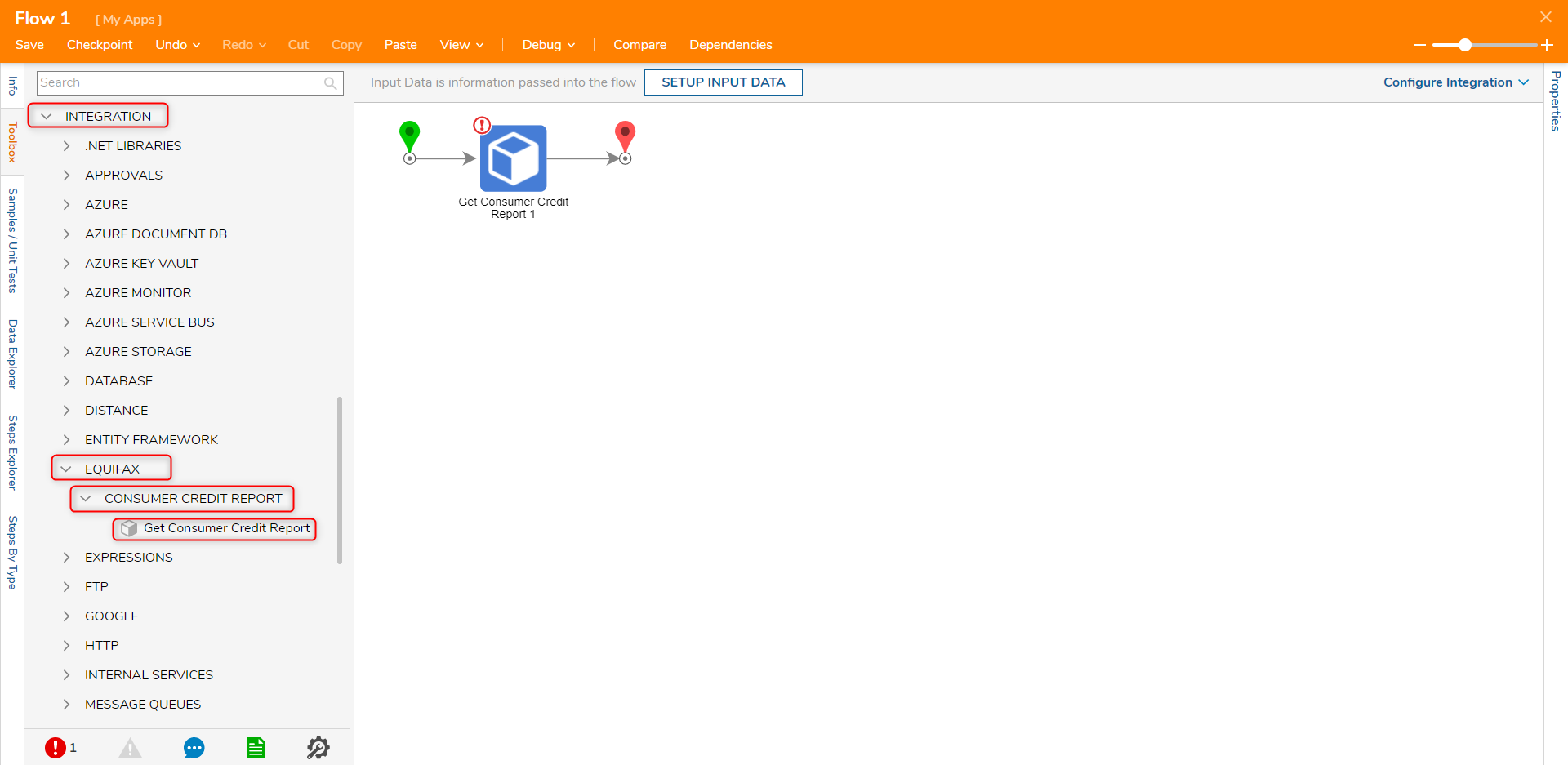

- When in a Flow Designer, the step Get Consumer Credit Report is available. It is found by navigating to INTEGRATION > EQUIFAX > CONSUMER CREDIT REPORT in the Steps Toolbox.

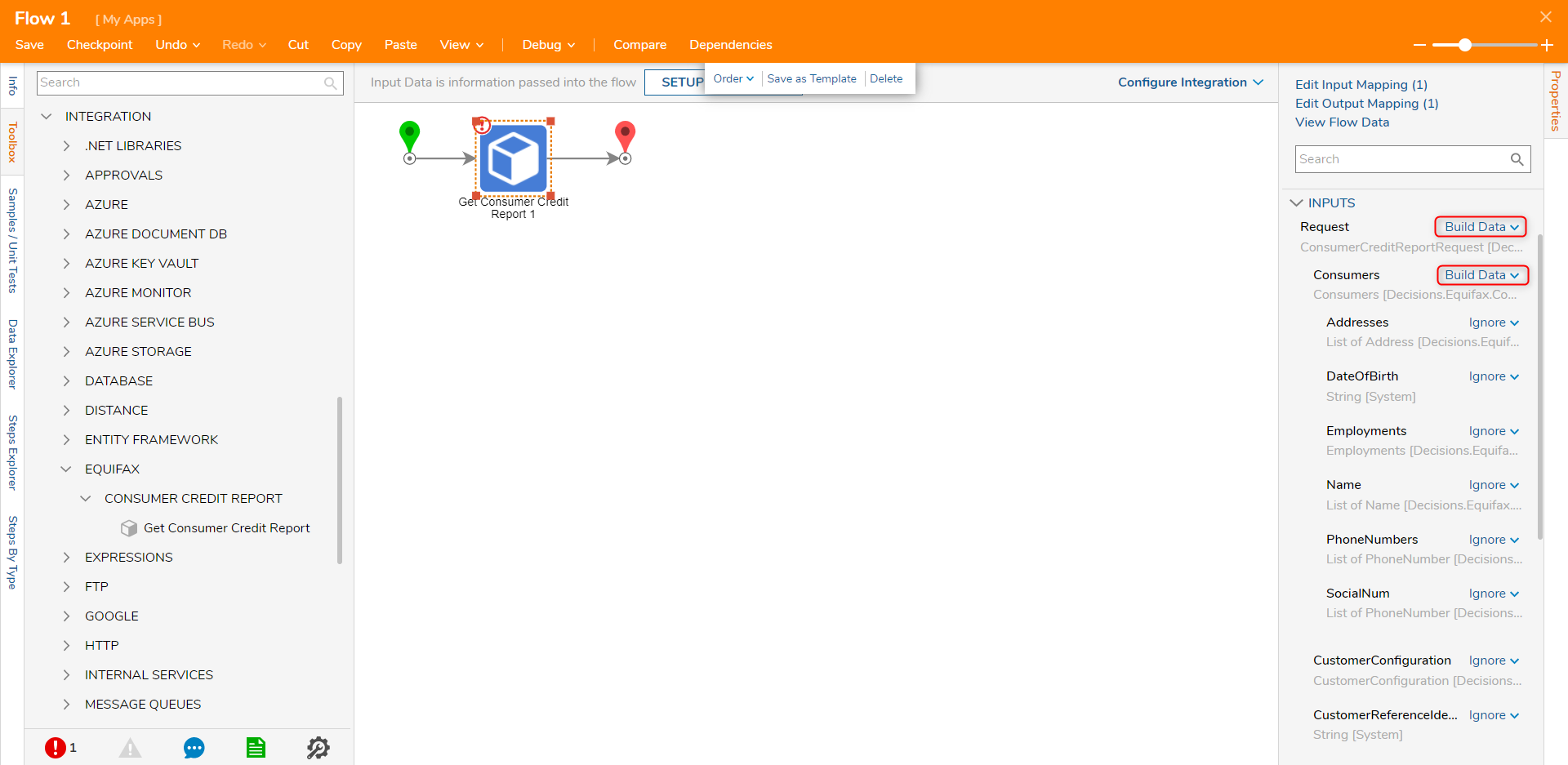

- On the Properties panel, select Unknown next to the Request field under the INPUTS category and select Build Data. Click Unknown for the Consumers field and select Build Data.

Request Example

{

"consumers": {

"name": [

{

"identifier": "current",

"firstName": "SHEMICA",

"lastName": "XXSHJF",

"middleName": "FAYE",

"suffix": "X"

}

],

"socialNum": [

{

"identifier": "current",

"number": "666795307"

}

],

"dateOfBirth": "04281987",

"addresses": [

{

"identifier": "current",

"houseNumber": "7249",

"streetName": "PAJJ ZAFW",

"streetType": "LN",

"apartmentNumber": "12",

"city": "HUMBLE",

"state": "TX",

"zip": "77396"

}

],

"phoneNumbers": [

{

"identifier": "current",

"number": "4585856325"

}

],

"employments": {

"occupation": "VELLA",

"employerName": "XYZ"

}

},

"customerReferenceIdentifier": "JSON",

"customerConfiguration": {

"equifaxUSConsumerCreditReport": {

"memberNumber": "999XX00000",

"securityCode": "XXX",

"codeDescriptionRequired": true,

"models": [

{

"identifier": "02583"

}

],

"endUserInformation": {

"endUsersName": "ALABASTER INC",

"permissiblePurposeCode": "01"

},

"customerCode": "BQ81",

"multipleReportIndicator": "F",

"ECOAInquiryType": "Individual",

"optionalFeatureCode": [

"X"

],

"pdfComboIndicator": "Y",

"vendorIdentificationCode": "FI"

}

}

}

For further information on Modules, visit the Decisions Forum.