| Step Details | |

| Introduced in Version | 4.0.0 |

| Last Modified in Version | 7.12.0 |

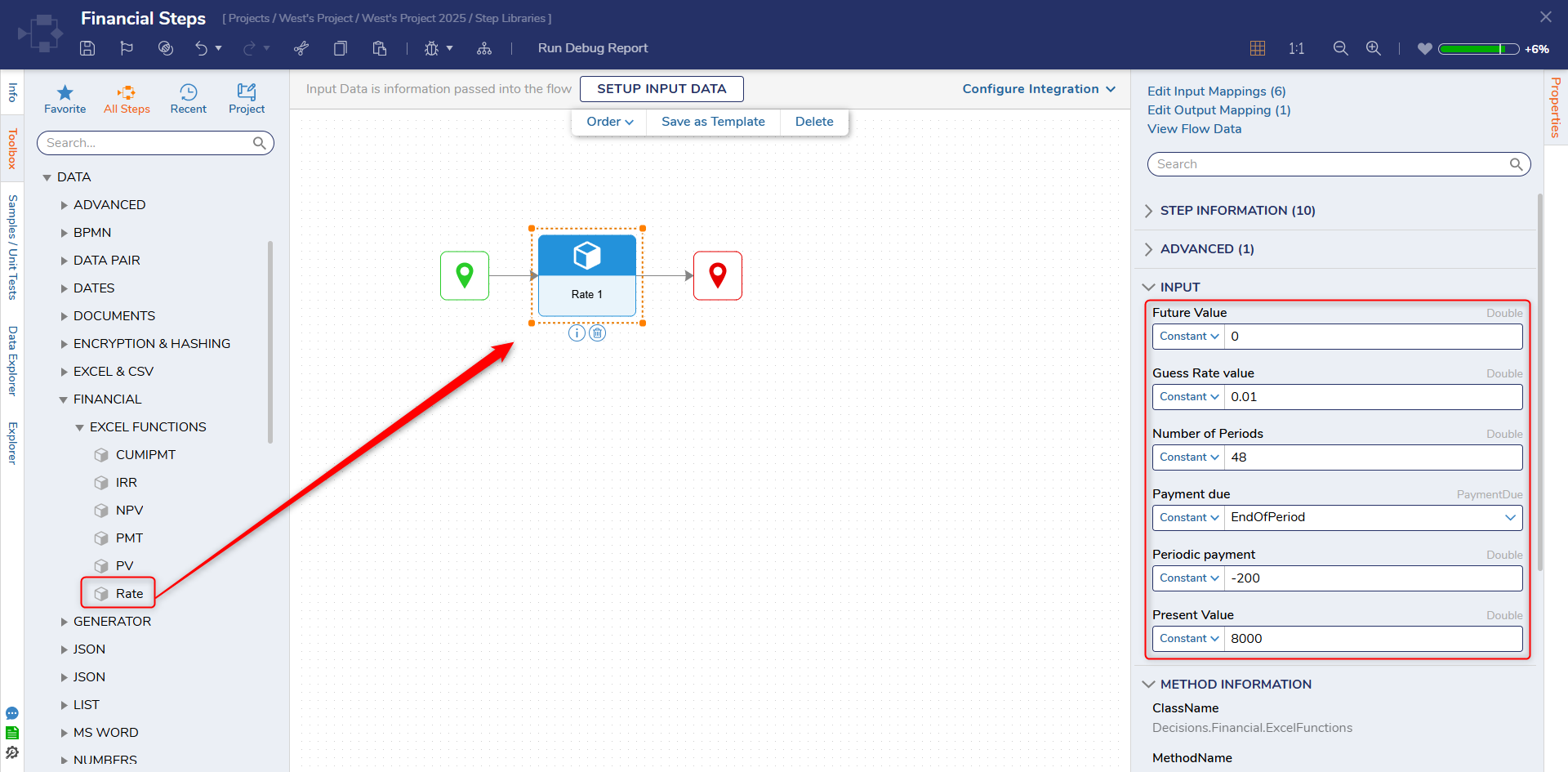

| Location | Data > Financial > Excel Functions |

The RATE step is available in the Finance module. The RATE function is a financial function that calculates the interest rate per period of an annuity. An annuity is a series of equal payments made at regular intervals. RATE is used to determine the interest rate at which these payments are made. It is particularly valuable when needing to calculate the interest rate for loans, mortgages, or investments involving consistent payments.

Prerequisites

This step requires the Financial module to be installed before it will be available in the toolbox.

Properties

Inputs

| Property | Description | Data Type |

|---|---|---|

| Future Value | The future value, or a cash balance after the last payment. | Double |

| Guess Rate Value | A guess for what the rate will be. | Double |

| Number of Periods | This property represents the total number of payment periods. It defines the duration over which cumulative interest is calculated. The number of periods can be a whole number or a decimal depending on the frequency of payments. | Double |

| Payment due | This property indicates the timing of the payment, which can be either "End of Period" or "Beginning of Period." It determines whether payments are made at the end or the beginning of each compounding period. | PaymentDue |

| Periodic Payment | The payment that is made each period. For example, the monthly payments on a $10,000, four-year car loan at 12 percent are $263.33. Enter -263.33 as the Periodic Payment. | Double |

| Present Value | The present value represents the initial principal amount or the current value. | Double |

Outputs

| Property | Description | Data Type |

|---|---|---|

| Rate1_Output | Double |

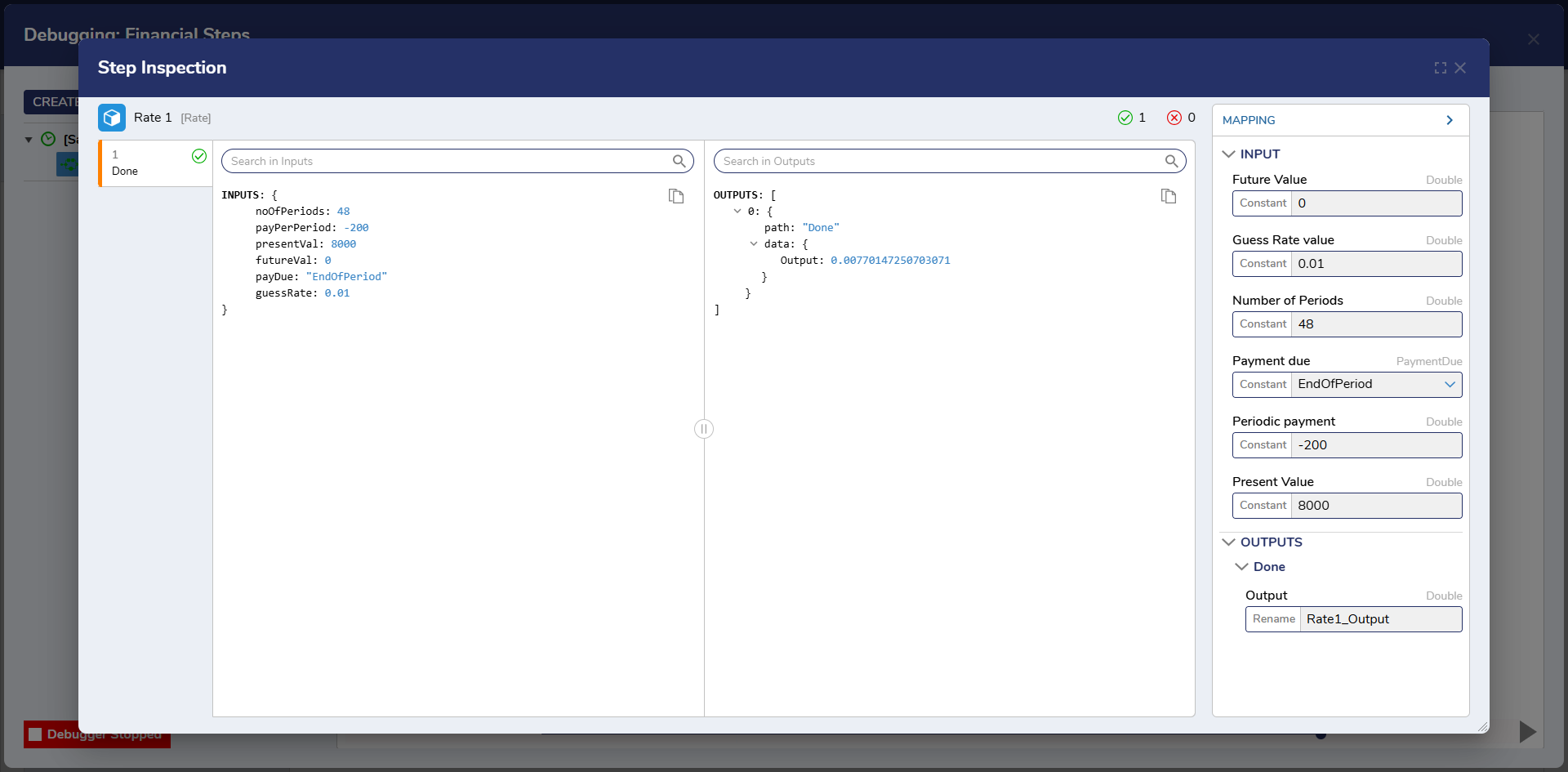

Example Inputs and Outputs

| Future Value | Guess Rate Value | Number of Periods | Payment due | Periodic Payment | Present Value | Output |

|---|---|---|---|---|---|---|

| 0 | .01 | 48 | EndOfPeriod | -200 | 8000 | 0.0077014724882021185 |

| 0 | .025 | 360 | BeginningOfPeriod | -1900 | 325000 | 0.004842403391352224 |

Common Errors

Invalid Inputs

If the Number of Periods, Periodic Payment, or Present Value inputs are empty, the step will return an error. Please ensure these inputs have data mapped correctly.

Exception Message:

Exception Stack Trace: DecisionsFramework.BusinessRuleException: [BusinessRule] Parameter 'noOfPeriods' of 'Rate' can not be null at DecisionsFramework.Design.Flow.CoreSteps.InvokeMethodUtility.ThrowErrorIfNullIsNotAllowed(MethodInfo methodInfo, Object[] parameterValues, String errorMessage

at DecisionsFramework.Design.Flow.StepImplementations.InvokeMethodStep.Run(StepStartData data

at DecisionsFramework.Design.Flow.FlowStep.RunStepInternal(String flowTrackingID, String stepTrackingID, KeyValuePairDataStructure[] stepRunDataValues, AbstractFlowTrackingData trackingData

at DecisionsFramework.Design.Flow.FlowStep.Start(String flowTrackingID, String stepTrackingID, FlowStateData data, AbstractFlowTrackingData trackingData, RunningStepData currentStepData)